See listing of Recent and Most Popular articles on the Home Page

Finance and Legal

Category: Work, Employment / Topics: Demographics • Financial • Trends • Work

Working Longer, Earning More

by Stu Johnson

Posted: April 27, 2018

Census research reveals significant trend…

By 2030, the U.S. Census Bureau projects that one in every five residents will be older than age 65. What do we know about older workers’ labor market participation and earnings today?

We know that the number of older workers is on the rise. We also know that these workers are not only making more money on average than ever before but are outpacing the average earnings growth of other age groups.

That is the observation of Erika McEntarfer, in a recent posting from the U.S. Census Bureau, “

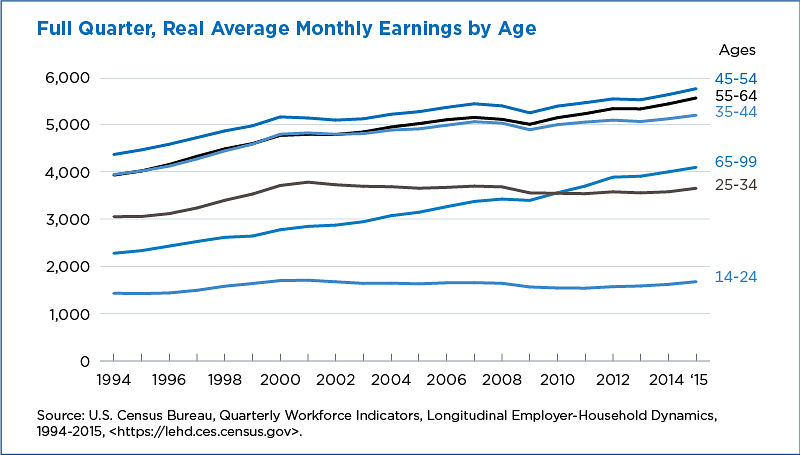

The analysis in McEntarfer's brief report centers on this chart:

Click on image to enlarge (open a new window/tab)

Here are some of the significant points in the Census Bureau story and my own insights from general demographic research:

- The ratio of workers to population of persons aged 65 and over has risen from 12% in the mid-1990s to over 18% in 2015-16, the latest available data. (Bureau of Labor Statistics) While that leaves more than 80% of those 65 and older outside the work force, it is a demonstrable trend that could very well accelerate as more Baby Boomers turn 65 and longevity continues to increase.

- “…not only are older persons working more, but they are earning more than in previous years.” (James Spletzer, Principal Economist at the Center for Economic Studies)

- As the chart indicates, average monthly earnings, adjusted for inflation, rose for all age groups from 1994 through 2000, when it levelled off for the youngest groups (14-24 and 25-34) and increased more slowly for the three groups from 35 to 64 years old. Striklngly, the 65+ age group was the only one to show a steady increase in monthly earnings since 1994.

- Inflation-adjusted average monthly earnings for older workers rose from $2,274 in 1994 to $4,092 in 2015, an 80% increase—the largest of any age group. Other groups ranged from 17% for ages 14-24 to 41% for 55-64.

- Inflation from 1994 to 2015 was 37% (US Inflation Calculator). That represents an average of 1.7% per year. The average increase in wages reported here means that real earnings improved by less than 1% per year for the youngest group to nearly 4% for the oldest, and roughly 1.5-2.0% for the three highest-paid groups (35-64).

- The highest average monthly earning in 2015 was $5,753 for ages 45-54.

- Even though we can assume that many in the 65+ group are working part-time, their monthly earning remained higher than the two youngest groups.

- A potentially troubling trend deserving attention is the levelling in the trend for 24-34, the group that traditionally would be entering the workforce and starting to move up. Since 2000 this age group has not only seen monthly earnings plateau, but move down slightly. From the chart, it can be deduced that all of its 20% gain occurred between 1994 and 2000. Remember that people are passing through these age groups—the 18 year-old in 1994 was 41 in 2015, and the 50-year-old in the peak earning group in 1994 was 71 in 2015. The potentially worrisome thing about the flattening of the 25-34 trend line is what it says about work in America and the apparent break in patterns established in post-World War II decades that created a large and vibrant middle class.

- Even worse is the nearly flat trend for the 14-24 group, which saw an increase in inflation-adjusted earnings of only $245 per month, or 17% over two decades.

We all know of people—perhaps yourself included, if you’re in that older group—who have delayed retirement or sought other employment after retirement, some to remain active, but others because they need the income to survive (or maintain a standard of living closer to what they were used to before retirement). As McEntarfer observes:

The earnings statistics cited in this release do not indicate the source of the earnings. Further research is needed to distinguish what percent of older workers are working full-time at jobs where they have worked for many years, versus what percent of older workers are in part-time jobs. More research is also needed to understand the degree to which the earnings of older workers supplements any retirement income they receive from other sources.

The comments above include my own observations. Follow the link at the beginning to see the original posting on the Census Bureau website, where you will find additional links and technical details in a “Data Appendix.”

This article also appears in my InfoMatters blog on sjassociates.com

Search all articles by Stu Johnson

Stu Johnson is principal of Stuart Johnson & Associates, a communications consultancy in Wheaton, Illinois. He is publisher and editor of SeniorLifestyle, writes the InfoMatters blog on his own website and contributes articles for SeniorLifestyle. • Author bio (website*) • E-mail the author (moc.setaicossajs@uts*) • Author's website (personal or primary**)* For web-based email, you may need to copy and paste the address yourself.

** opens in a new tab or window. Close it to return here.

Posted: April 27, 2018 Accessed 1,652 times

![]() Go to the list of most recent Finance and Legal Articles

Go to the list of most recent Finance and Legal Articles

![]() Search Finance and Legal (You can expand the search to the entire site)

Search Finance and Legal (You can expand the search to the entire site)

![]() Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Loading requested view...

Loading requested view...