See listing of Recent and Most Popular articles on the Home Page

Health & Wellness

Category: News & Current Events / Topics: COVID-19 • Crisis • Dying and Death • Disease • History • News • Statistics • Trends

COVID-19 Perspectives for December 2021

by Stu Johnson

Posted: January 5, 2022

Like a global game of Whack-a-Mole, omicron hits Europe hard, USA to a lesser extent, with minimal impact seen elsewhere so far in COVID statistics…

Putting the COVID-19 pandemic numbers in perspective (Number 18)

See a list of all of my articles related to COVID-19

This monthly report was spawned by my interest in making sense of numbers that are often misinterpreted in the media or overwhelming in detail (some would say that these reports are too detailed, but I am trying to give you a picture of how the COVID pandemic in the United States compares with the rest of the world, to give you a sense of perspective).

These reports will continue as long as the pandemic persists around the world.

Report Sections:

• December-at-a-glance

• The Continental View • USA Compared with Other Countries

• COVID Deaths Compared to the Leading Causes of Death in the U.S.

• U.S. COVID Cases versus Vaccinations

• Profile of Monitored Continents & Countries • Scope of This Report

December-at-a-glance

GLOBAL SNAPSHOT

COVID-19 continued to spread around the world, with the omicron variant producing renewed, strong surges in Europe, with USA not far behind, while other parts of the world continued at pre-omicron levels. While omicron is producing breakthrough infections among the vaccinated and news reports focus on strains on the health care system, the proportion of cases requiring hospitalization is lower than previous surges and mortality rates (proportion of cases leading to death) continue to decline. Reports since the delta variant emerged in late summer 2021 continue to point to the high concentration of unvaccinated people among those requiring hospitalization. Thus, the constant drumbeat for getting vaccinated and boosted.

EXECUTIVE SUMMARY

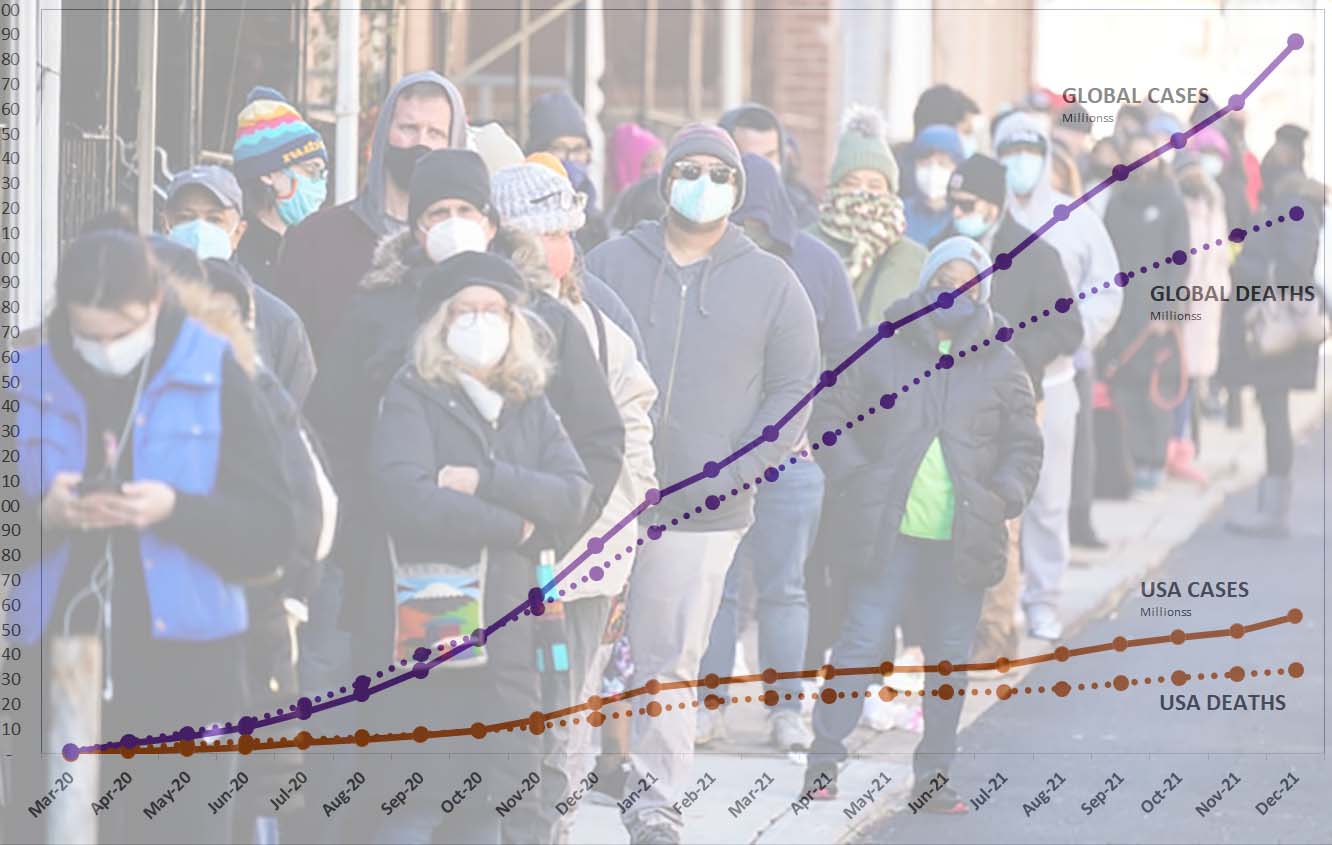

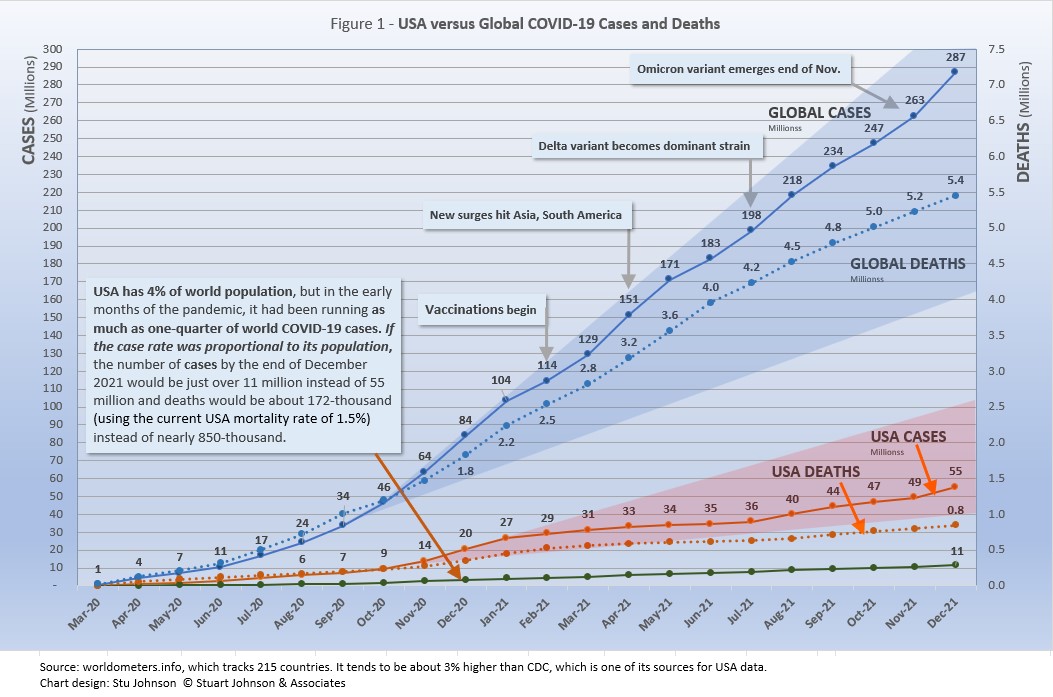

- Global CASES reached 287-million by the end of December, 9% more than November (which was 6% ahead of October).

That represents 3.6% of the global population of 7.9-billion, up from 3.3% at the end of November.

The blue "cone" in Figure 1 shows a possible high and low projection of global cases, with the bottom (roughly 160-million) representing the trajectory of the lower pace in late summer 2020 and the upper (approximately 320-million) representing a continuation of the major surge from November 2020 through January 2021. Cases have stayed below the upper projection, bending down several times in 2021, but bending upward again with surges in late spring, the delta variant in late summer, and now omicron.

- DEATHS from COVID around the world continued at the same pace as last month, up 4% to 5.4-million.

The pattern for global deaths tends to lag behind cases by weeks or months, but the global rate of increase continues to fall below that of cases—dropping from a 23% increase in January 2021 to 4% at the end of November and December. While the curve for deaths is still rising, Figure 1 shows a noticeable slowdown since early summer.

- BY CONTINENT. Where South America was clearly going the wrong way through early summer, things have significantly reversed, with Europe becoming the hot spot during December. South America, in fact, now leads the world in rates of vaccination, though the early trouble is still seen in countries such as Peru, Bolivia and Ecuador. You can see these differences in The Continental View and USA Compared to Other Countries details below.

- USA continues to lead the world in the number of reported cases and deaths, but also leads the world in the number of COVID tests and is respectable in vaccinations, but hampered by vaccine resistance.

While the 16.7% USA share of global cases at the end of December was down from a high of 25.9% in January 2021, the trend has been eratic but moving down overall. In fact, this month we saw several European countries pass USA for cumulaitve cases as a proportion of population.

Similarly, deaths have declined from 20.9% of the world total in September 2020 to 14.5% at the end of August 2021 before heading back up slightly through Decemberr. As you will see in details to follow, while USA outpaced everyone through the early months of the pandemic, the vast disparity was slowly shrinking even as the delta and omicron variants brought renewed surges. The duration and intensity for delta was less than early news reports suggested would likely be the case. We will have to observe omicron for another month or two to measure its severity.

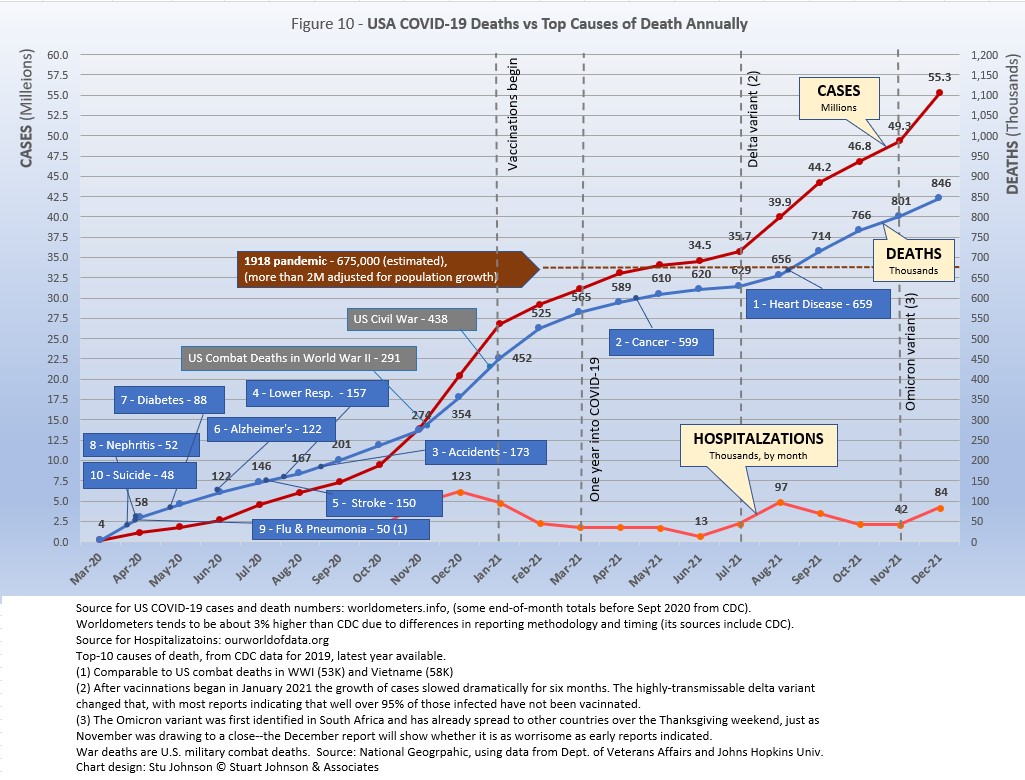

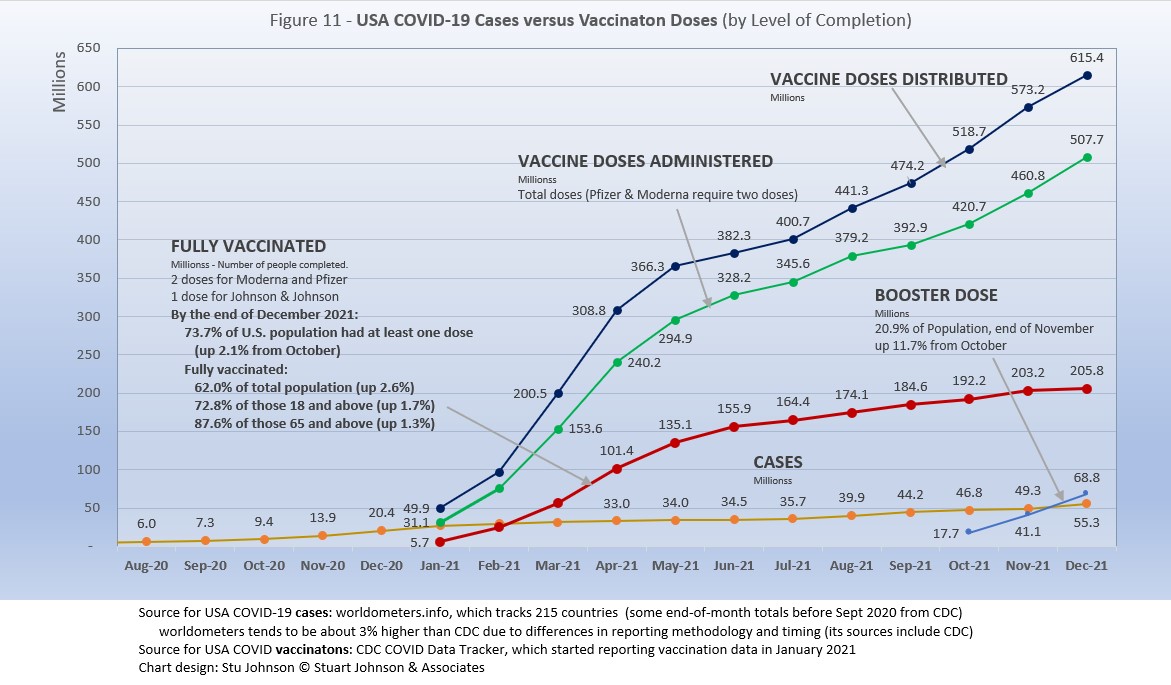

The projection cone surrounding USA Cases in Figure 1 shows a pronounced flattening of the curve from January to July 2021 (vaccinations), with a very noticeable upward bend in August (delta variant among unvaccinated) and another in December (omicron variant among unvaccinated and "breakthrough" infections of vaccinated)—though still in the bottom half of the projection cone, which for USA extends from roughly 30- to 100-million. The upward bend for USA cases from August to December is clearly visible in Figure 1, but even more pronounced in Figure 10 below, which "zooms in" on USA. Figure 11 provides a detailed view of USA vaccination.

Figure 1 also shows how much lower cases in USA would be—approaching 11-million by now, instead of 55-million—if they were proportional to the global population. It would also mean about 172-thousand deaths instead of nearly 850-thousand. - THE OMICRON VARIANT emerged at the end of November and hit Europe hard, bringing back lockdowns and severe restrictions in several countries. It is now hitting USA, but we won't know how it compares with Europe until the next report. Likewise, Africa, Asia and South America, which seem relatively unaffected right now, could find themselves in renewed surges. The back-and-forth in surges between continents and countries is ike a global game of Whack-a-Mole, which clearly indidcates that no one can be complacent.

While wirtten last month, for a good overview, see "We won't know how bad omicron is for another month" by Antonio Regalado, reported in the MIT Technology Review.

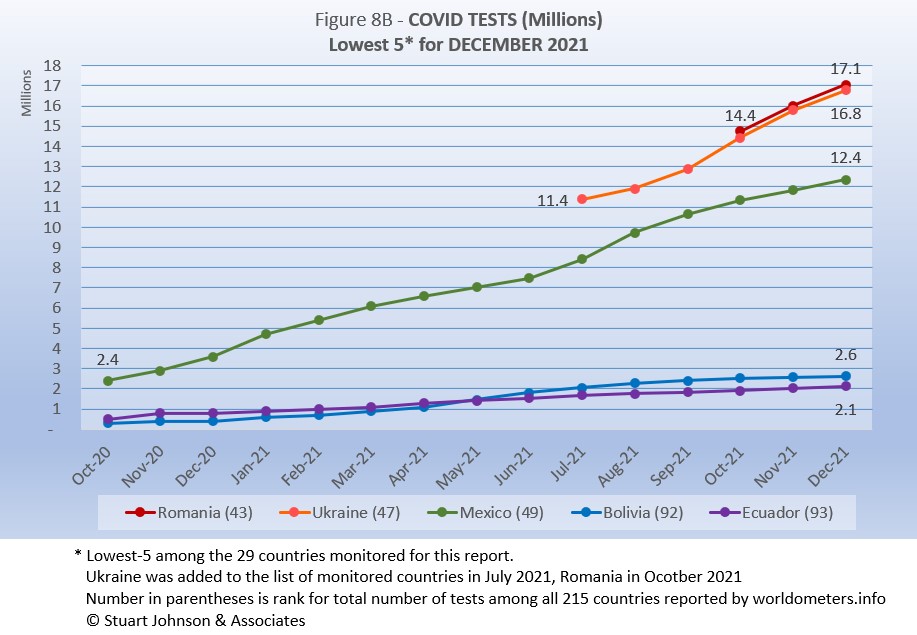

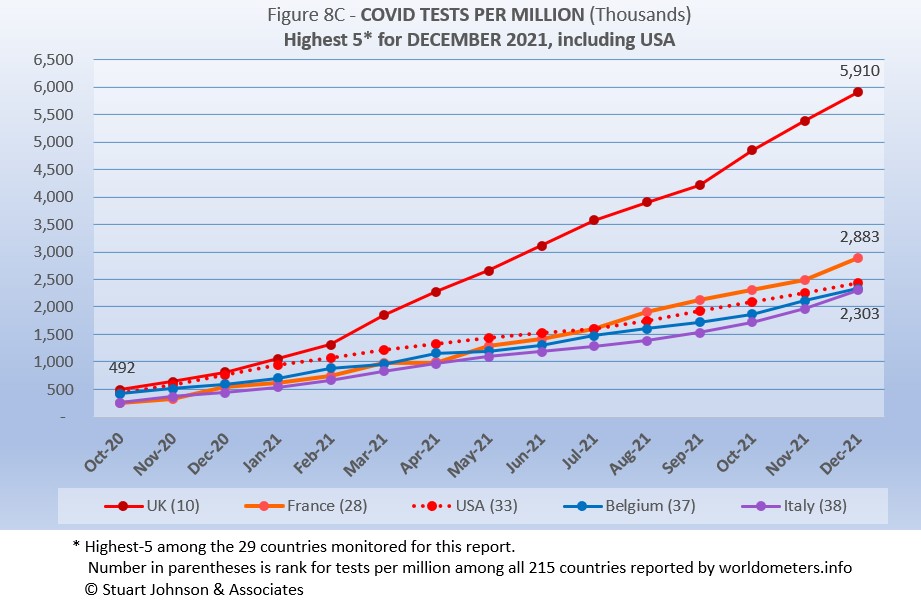

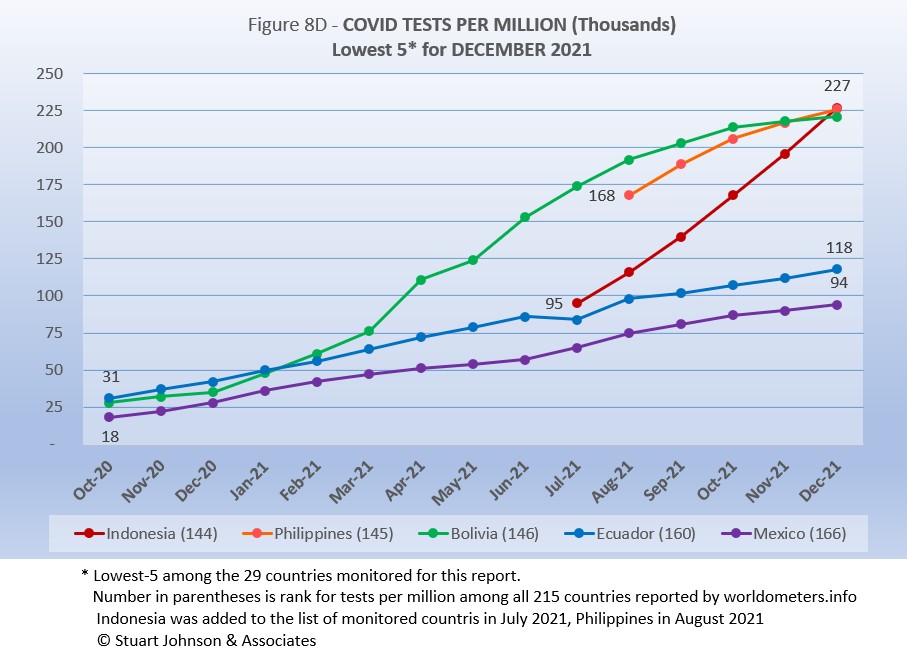

- TESTING. USA leads in the number of tests, with 811-million, followed by India, UK, Russia and France. Of the 29 countires monitored for this report, Romania, Ukraine, Mexico, Bolivia and Ecuador report the lowest number of tests. By proportion of population (tests-per-millon), UK is far ahead of others, with the equivalent of nearly 6 tests per person. USA is about 2.5 tests per person, similar to the other top countries. At the low end, the number of tests covers 20% or less of population. (See figures 8A, 8B, 8C, and 8D). Home tests will typically not be reported because there is no way of accurately recording them.

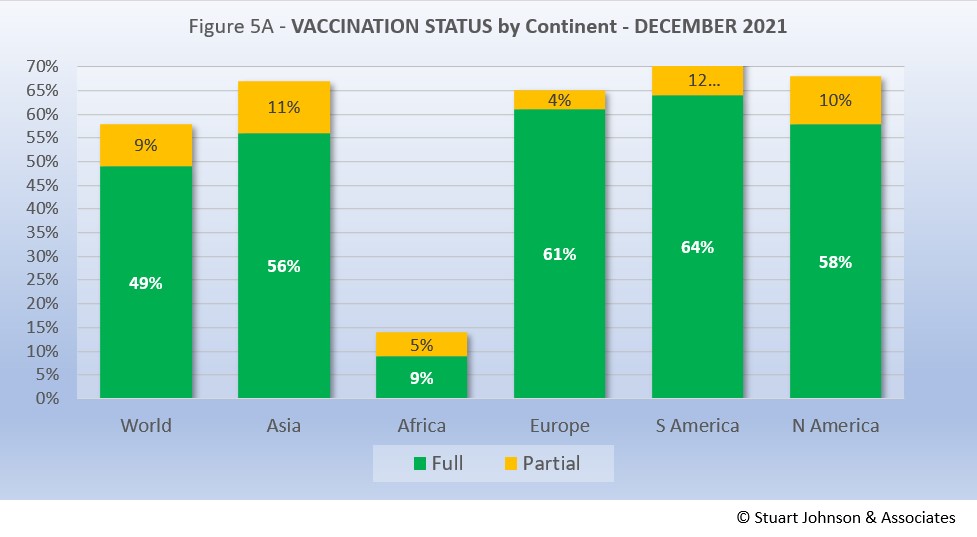

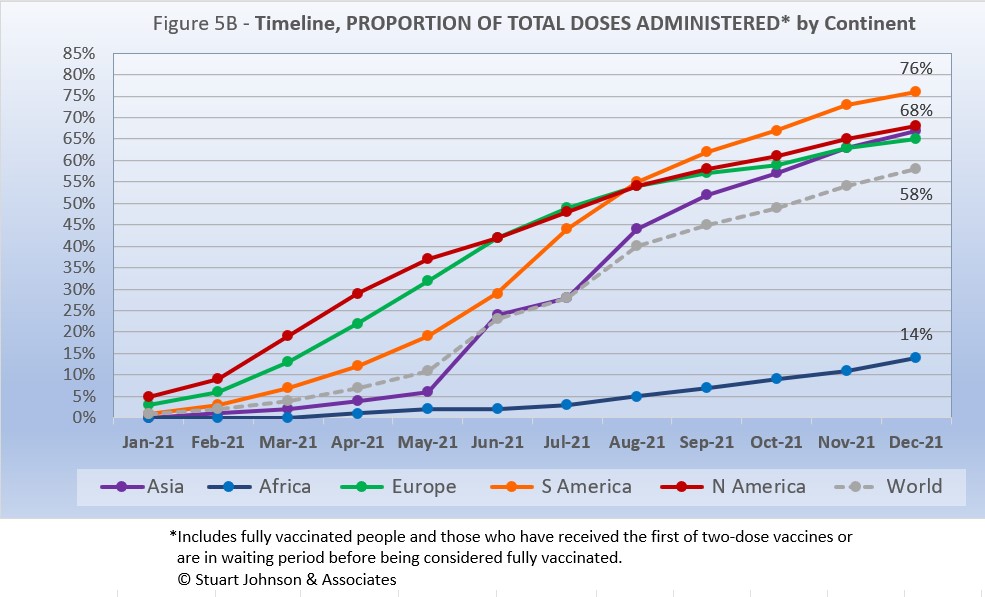

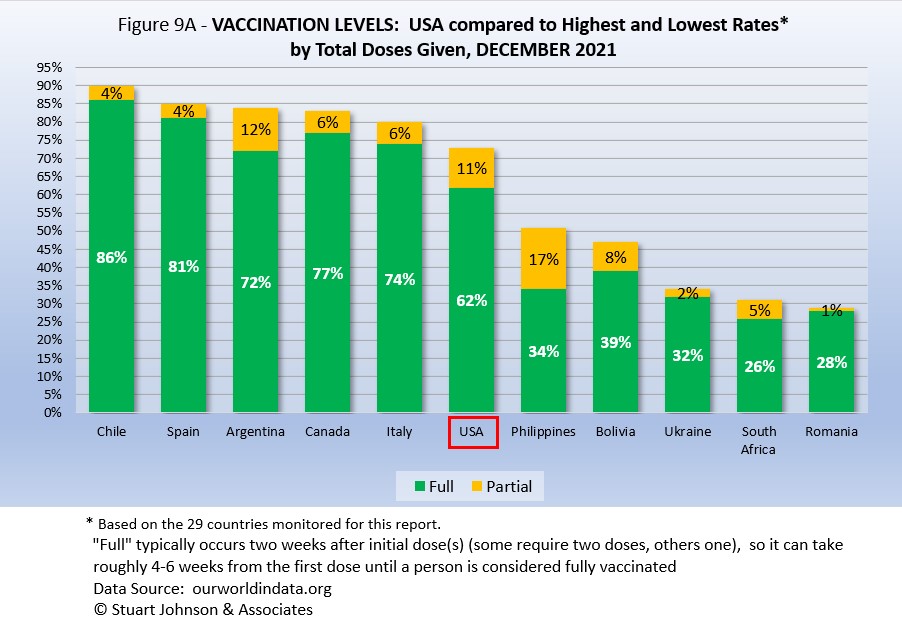

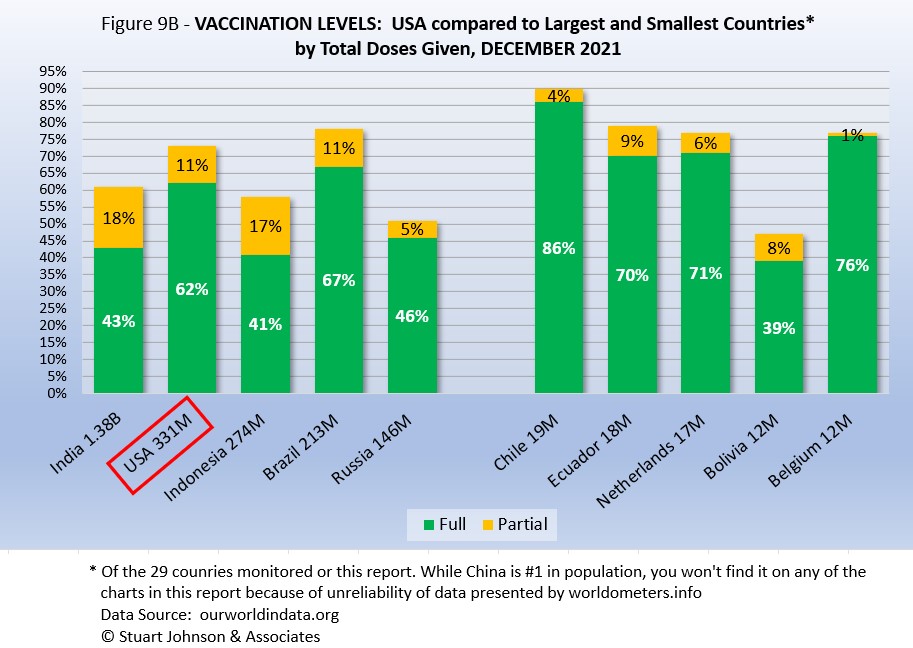

- VACCINATIONS. 58% of the world's population have been reported as receiving at least one dose of vaccine by the end of December. (See figures 5A, 5B, 5C, 9A, 9B and 11).

South America leads the world in vaccination, with Chile reporting 86% fully vaccinated. USA continues to move ahead slowly, with 62% fully vaccinated at the end of December and another 11% partially vacinnated.

- COUNTRIES TO WATCH. No countries have been added to the list of countries that I monitor. The weekly comparison report on worldometers.info, however, gives a sense of hot spots to watch. Based on weekly activity, this includes Greece, Australia, Hungary, Portugal, Denmark, Ireland, Bulgaria, South Korea, Vietnam, Switzerland, and Georgia—all in the top 20 of new cases and/or deaths in the last week of December. While some of these have populations too small to make much of an impact on this report, they generally confirm (along with countries recently added to my monitored list) that the shift toward southeast Asia and the Middle East in previous months has shifted to renewed surges in Europe, which cast a pale on the holiday season.

Where you get information on COVID is important. In an atmosphere wary of misinformation, "news-by-anecdote" from otherwise trusted sources can itself be a form of misinformation. As I go through the statistics each month, I am reminded often that the numbers do not always line up with the impressions from the news. With that caveat, let's dig into the numbers for December 2021.

THE CONTINENTAL VIEW

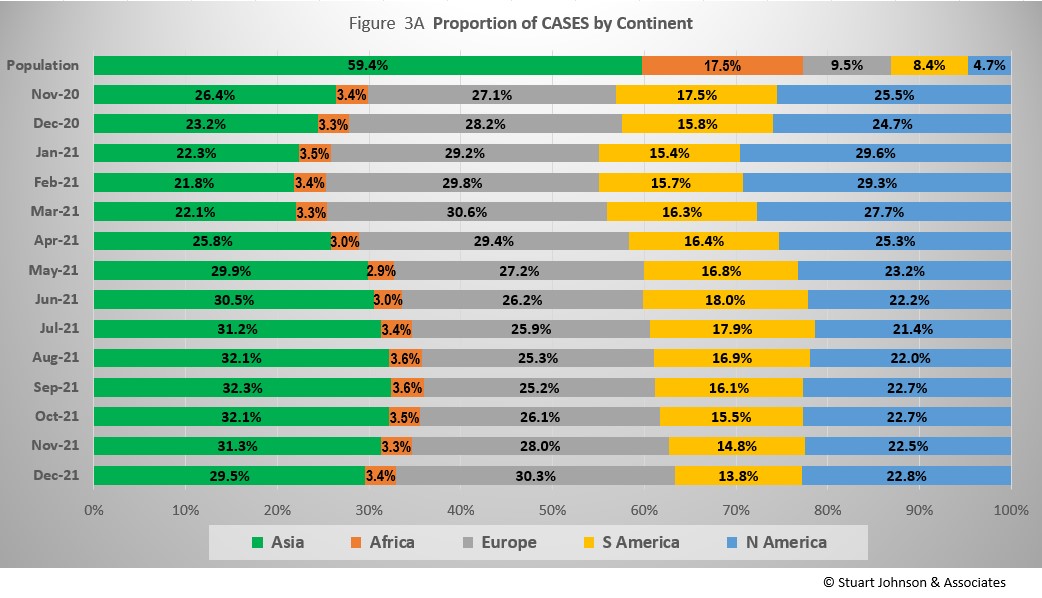

The most obvious change in December is the increasing surge of COVID cases in Europe and the beginnings of an omicron-related surge in USA. The other major continents either continued at their recent pace or slowed somewhat in growth of cases. Oceana is not included because of its small size, about one-half a percent of world population.

While COVID-19 has been classified as a global pandemic, it is not distributed evenly around the world.

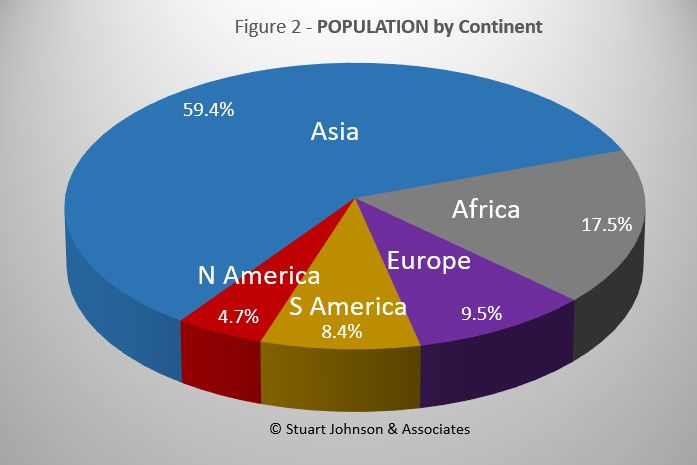

Asia accounts for 59.4% of the world's population (Figure 2), but had only 29.5% of COVID cases at the end of December (Figure 3A)—affecting a mere 1.8% of its population—down from a high of 32.3% in September. (COVID cases now represent 3.6% of world population).

The biggest trends in the proportion of cases among continents are most noticeable since March:

- Asia - rising to a peak of just over 32% in September, then declining the last three months

- Europe - falling through September to just over 25% from a high of nearly 31% in March, Europe is back to 30%

- North America - falling through July from a high of nearly 30% in January, then back up slightly, but remaining below 23% for the last five months

- South America - after peaking at 18% in June, steadily descending to just under its low of 14% in December

- Africa - hovering around 3.5%

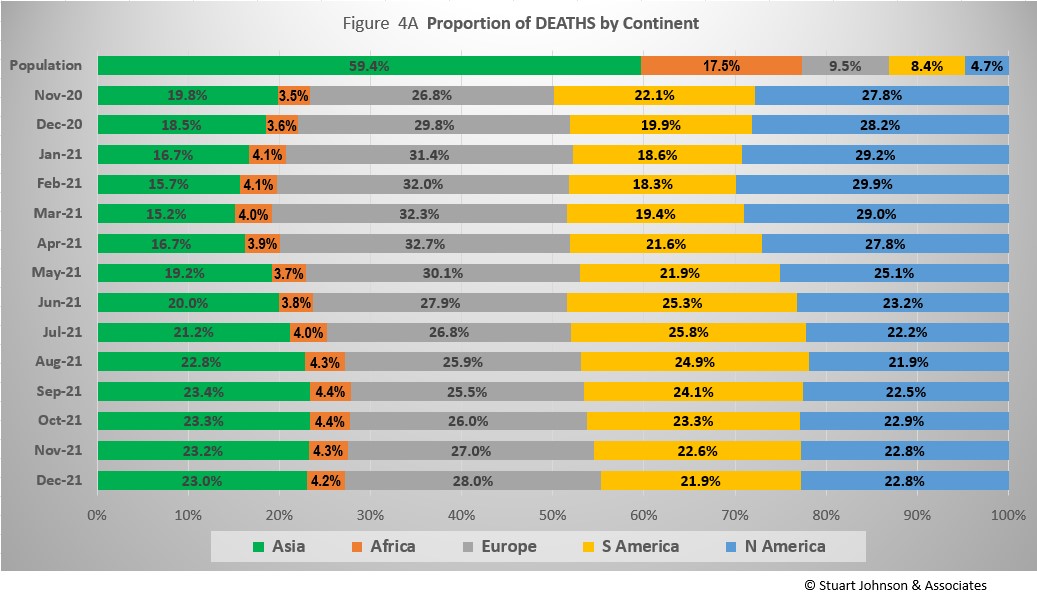

Where Asia and Africa combined represent about three-quarters (76.9%) of the world's 7.9-billion people, Europe, South America and North America still account for two-thirds of COVID cases (66.9% - Figure 3A) and about 7 in 10 of COVID deaths (72.7% - Figure 4A). The shares for Europe and the Americas combined were slowly coming down from their highs (74.7% for cases and 80.8% for deaths in February), before moving back up each month since September because of delta and omicron (Europe much more noticeabley than North America).

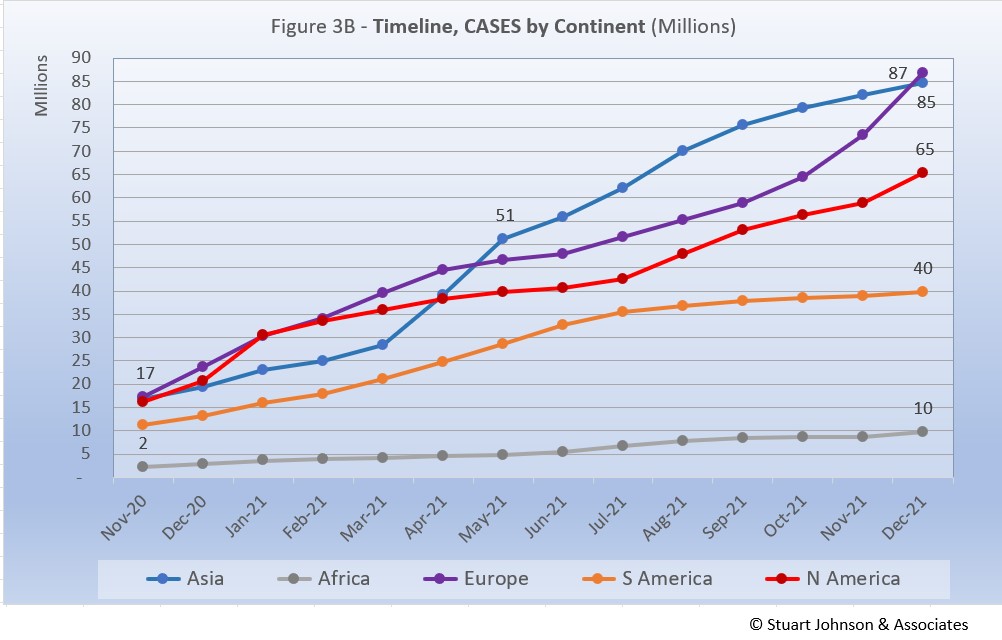

While news reports continue to give the impression of widespread delta and omicron variant surges, growth in the number of cases since July has shown it is focused particularly on Europe, followed to a lesser extent by North America, as clearly seen in Figure 3B. While Asia was ranked number 1 in November, Europe edged past it in December with a radical upward turn over two months. North America also bent upward, but not nearly as much as Europe.

Meanwhile, Asia has shown a slight flattening of cases since September, while South America extended a flattening that began in August and Africa remains far below the others with very minor changes from month to month.

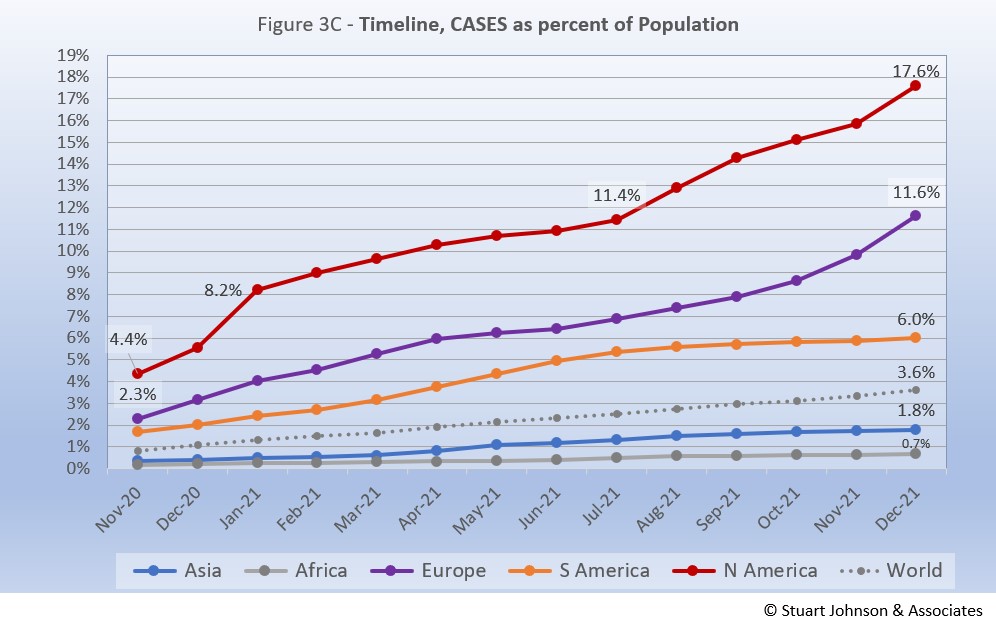

The raw numbers of Figure 3B can be deceptive. Figure 3C gives a more realistic picture of the impact by translating raw case numbers to percentage of population. The shape of the curves is similar to those for raw numbers, but the order and spacing paints a different picture.

After a sharp increase in January 2021, North America slowed down for six months, before jumping 1.5 points to 13.0% in August, continuing that pace into September before slowing slightly. Then omicron hit and pushed it to 17.6% at the end of December.

Europe remains well below North America, though its proportion of cases rose sharply from 7.9% in September to 11.6% in December. At the same time that Europe was trending upward, South America saw its curve flatten, rising only 0.6% since July, ending December at 6.0% of COVID cases in its population.

Asia and Africa, the two largest continents, remain at the bottom by proportion of COVID cases for their populations. Asia increased more noticeably than Africa between April and September, but both ended well below the global level of 3.6% at the end of December—Asia at 1.8% and Africa at 0.7%. In fact, it is the low proportions of Asia and Africa that have held the global curve to a nearly straight line progression. Omicron could still change that, but we'll have to watch.

The proportion of deaths between continents is even more distorted than that of cases. In the early months of COVID, Europe and the Americas were growing in deaths, causing Asia to bottom out in its proportion of global deaths at 15.2% in March. The trends since then shadow those of cases, but lag behind by a month of two.

- Europe retains the highest proportion of COVID deaths at 28%, up a full percentage point in November and December, but down from its high of nearly 33% in April—still more than double its share of world population.

- Asia ended December at 23% of world COVID deaths, down one or two tenths of a percent each of the last four month. That is still well above its low just above 15% in March—and far below its 59% proportion of world population.

- North America remains at 22.8% from November, with little change in proportion over the past four months.

- South America has steadily dropped from a high of nearly 26% in July to just under 22% at the end of December. Like Europe, both North and South America are well above their proportion of world population (8% for South America, nearly 5% for North America).

- Africa has hovered around 4%, with the last four months inching up then down again, but far below its 17% share of world population.

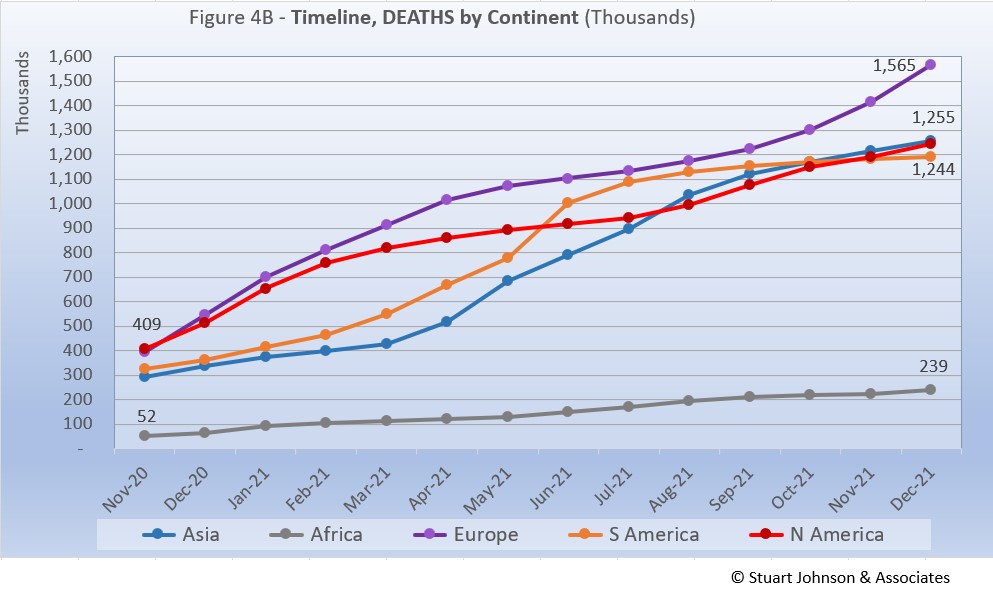

Deaths through December shows that while the trajectory lags behind cases and has progressed at a steadier rate, it does reflect the overall changes in Cases by continent. Except for Africa, which is well below the other continents in the number of COVID deaths, for the other four the 1-million milestone has been in the rear view mirror for months.

Europe remains at the top—and increased its lead due to the most obvious impact of the omicron variant—in number of deaths, at nearly 1.6-million.

South America was headed toward passing Europe back in the surge of early summer, then flattened, even as the delta variant was causing surges elsewhere. North America leveled off after vaccinations began in January, then started moving up again with the combination of vaccine resistance and both the delta and omicron variants.

Asia started to accelerate in May, on a path to join Europe, but started to slow in the last two months.

The result of these wandering curves is that Asia and North America were very close in number of deaths in December, while South America fell below them slightly. .

Meanwhile, Africa progressed at a fairly steady pace, well below the others both in level and rate of change, despite being second in size, with 1.3-billion people.

Vaccinations

As Figure 5A shows, nearly half of the global population has been reported as fully vaccinated (roughly 3.9 billion people), with another 9% having received the first of two doses. Given continuing gloomy reports in the news, those numbers may be surprisingly high given the monumental task of vaccinating multiple billions of people.

South America took the lead in total vaccinations in November (73%), and in December pulled away from Europe to have the highest rate of fuly vaccinated as well, at 64%. North America and Asia also surpassed Euopre in proporation of total vaccinations (68% and 67% versus 65%), but Europe leads the three in fully vaccinated, at 61%. Africa remains far below, with 14% having had at least one dose, up from 11% last month.

While South America got into vaccinations later and slower than North America and Europe, Figure 5B shows how it steadily pushed its way to the top of total vaccination doses administered by August, expanding its lead since then—and this by proportion of population, not raw numbers, so it's a fair comparison. Where North America started aggressively, it slowed in June as Europe caught up, then North America began to move ahead slightly, ending December at 68% compared to Europe at 65%.

The world trajectory was clearly influenced by Asia, which showed serious vaccination administration starting in June, moving upward to match Europe in November at 63% and surpass it in December at 67%. Africa remains far behind the others, though there is an encouraging upward movement beginning in July.

Because a majority of vaccines require two doses, we will likely see

total doses expand more quickly in coming months, with full vaccination catching up at a rate dependent on supply, strategy and willingness of populations to cooperate.

Comparison of U.S. with other CountriesCOMPARISON OF USA WITH OTHER COUNTRIES

Cases

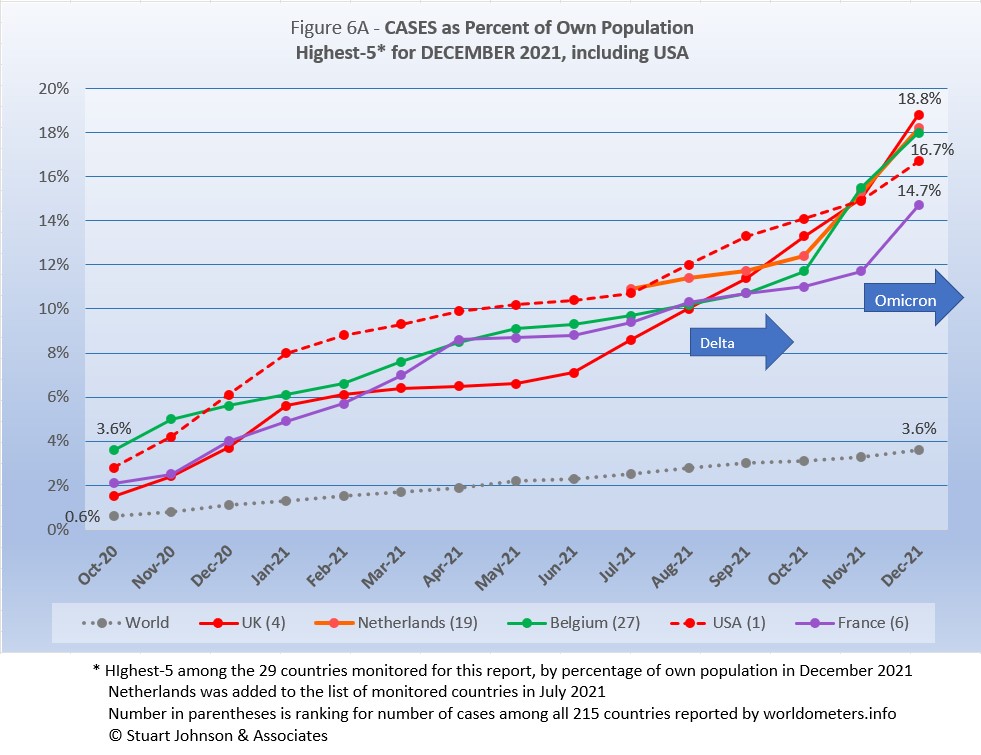

Raw numbers are virtually meaningless without relating them to the size of a given country, so looking at cases as a proportion of population helps get a sense of the relative impact. It is clear in Figure 6A that the delta variant had the most influence on UK and Belgium, while omicron (and the remains of delta) had a much more pronounced impact, particularly on the four European countries.

The same five coutnries appear at the top, but UK moves ahead, jumping from 15.0% to 18.8% since last month. Netherlands amd Belgium matched UK's stteep upturn since October.. USA shows only a slight upward bump in comparison, fallingbelow its virutal tie with the other three in November. France surged nearly as much as its European counterparts, but was a month behind, leaving it in fifth place.

Another way to look at population proportion is the measure "1 in." The global figure of 3.6% means that 1 in 28 people in the world have been reported with COVID (and that only by official record keeping, not including any unreported and likely asymptomatic cases). For UK and Netherlands, it is now 1 in 5; for Belgium and USA, 1 in 6; and for France, 1 in 7.

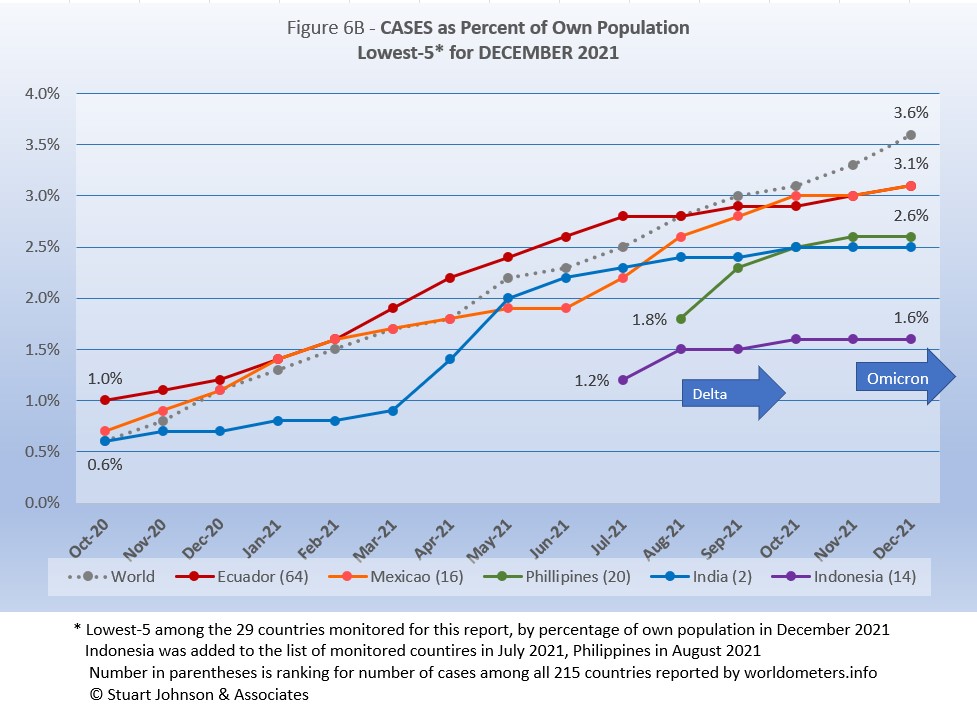

All five countries return from November, in the same order. All five have been at or below the global level since August, with little or no impact from delta or omicron (Figure 6A). In fact, the bottom three actually flattened in December and the top two were well below the slope of the global curve.

After crossing paths in October, Ecuador and Mexico have been tied in November and December. Philippines, added to the list of monitored countries in August, rose sharply in September, then began to slow, though it passed India last month. India started well below the global level, rose quickly in late spring 2021 to pass Mexico, but then slowed significantly and leveled off the last three months. Like Philippines, Indonesia, added to the list in July, started with a big jump its first month, then flattened out as the global curve continued to bend upward.

These countries represent a considerable spread in size, from India, the second largest country, to Ecuador, ranked number 67 of the 215 countries tracked by worldometers. For Ecuador, its 3.0% of population means that 1 in 32 have been reported as having had the COVID virus; for India it remains 1 in 40, and for Indonesia 1 in 64.

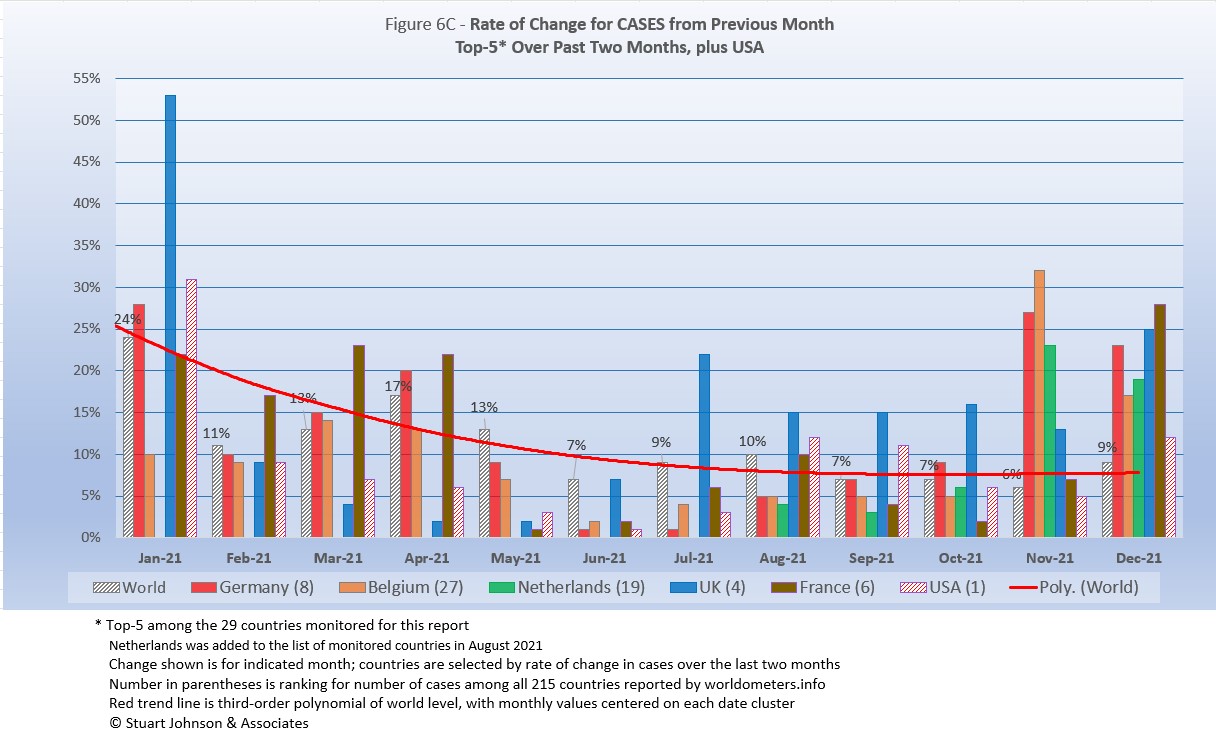

Because the size of countries makes the use of raw case numbers illusory, another measure I find helpful is the rate of change from month to month (Figure 6C). The focus of the selection is on recent changes, but the chart goes back to January to catch the end of the first major COVID surge, before vaccinatons began.

For this chart, countries are selected based on the change over two-months (end of October to end of December for this report). Ukraine has been replaced by France. USA, which appears in every report, remains below the top 5.

The overall trend (red line, reflecting global level) flattens as it drops, ending December at the low of 6%, though the actual global change went from 6% to 9%. (A polynomial trend line flexes as adjacent data points go up and down, so the leading edge of newest dates can change the shape of the curve as new months are added).

Overall, global levels were much higher from November 2020 through January 2021 (the highest period of surging cases as pointed out in Figure 1), as was the absolute variation between countries. Global levels remained over 10% through May, then have been at or below 10% since then.

Rather than pointing out individual countries from Figure 6C, what is most significant is the shifting pattern of countries experiencing surges over the months—the "whack-a-mole" effect exhibited by the COVID pandemic over time. Consider the changes since June of 2021::

| Month | Top-5 for Change in Cases Over 2 Months | Note | ||||

|---|---|---|---|---|---|---|

| June 2021 | India | Argentina | Columbia | Bolivia | Chile | South America surging |

| August 2021 | Iran | UK | Mexico | Spain | Russia | Delta begins |

| October 2021 | Philippines | UK | Ukraine | Turkey | Russia | Delta fading |

| December 2021 | Germany | Belgium | Netherlands | UK | France | Omicron strikes Europe |

USA started well above the Global level from November 2020 (48%) through January 2021 (31%), then dropped to 9% in February after vaccinations had begun and the surge seemed to have ended (in USA anyway). From there it fell further below the global level each month until reaching a low of 1% in June. This has reversed, with a small bump in July that was still well below the global level. Then August and September saw the delta surge push USA over the global level again, but not by much. Then two months below the global level of chnage, followed in December by omicron, with USA cases increasing by 12%—well below the top 5, but back above the global level.

Deaths

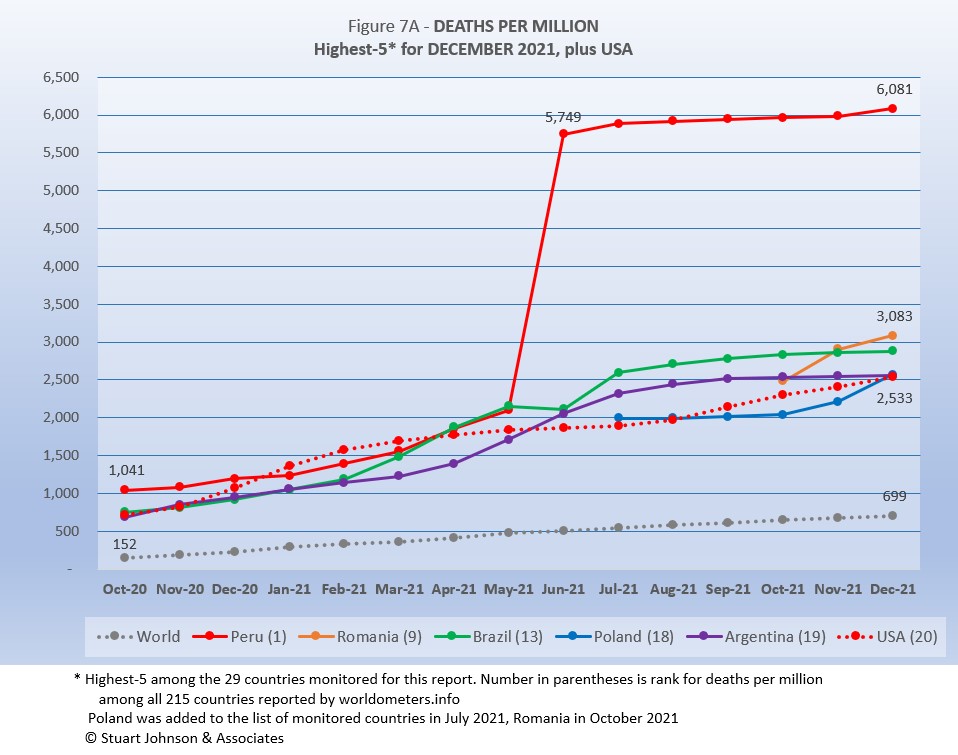

Because deaths as a percentage of population is such a small number, the "Deaths-per-Million" metric shown in Figure 7A provides a comparable measure.

Poland, added to the list of monitored countries in July, replaces Colombia. The other four countries return from November.

As Figure 7A shows, Peru still soars over the others following a correction to its death data in June. November remains double #2 Romania and nearly 9 times the Global level..

While the worst deaths-per-million is still represented by three South American countries, as suggested in other parts of the report there has been a slowing and even some flattening evident in the last five months. Peru, Argentina, and Colombia have all seen a flattening of the deaths-per-million curve (the number cannot go down, but growth can flatten). Poland started flat before it—along with Romania—accelerated in response to the omicron variant.

USA rose steadily until evidence of the effectiveness of vaccination began to become evident with a slow down from March through July. It turned back upward in August, coinciding with the delta variant and vaccine resistance. USA is on a track to get back in the top-5 if it surpasses Argentina or Poland next month, which could happen, though the death rate in USA has not been influenced much to date by the delta or omicron variants.

Since this analysis focuses on 29 countries that have been in the top-20 of cases and deaths, there are 7 other countries not monitored with Deaths-per-Million between Peru, with a population of 33.5M, and Romania, with 19.1M. The largest are Bulgaria (6.9M, 4,524 Deaths-per-Million), Hungary (9.6M, 4,106), and Czechia (10.7M, 3,388).

All of the countries on the chart, including USA, are all well above the Global level, and (except for Peru) fairly close to each other.

While the delta variant was causing cases to rise, particularly in July and August, death rates in general remained unaffected or low in comparison—even South America, which had been the exception, is slowing down. This also seems to be true with the omicron variant.

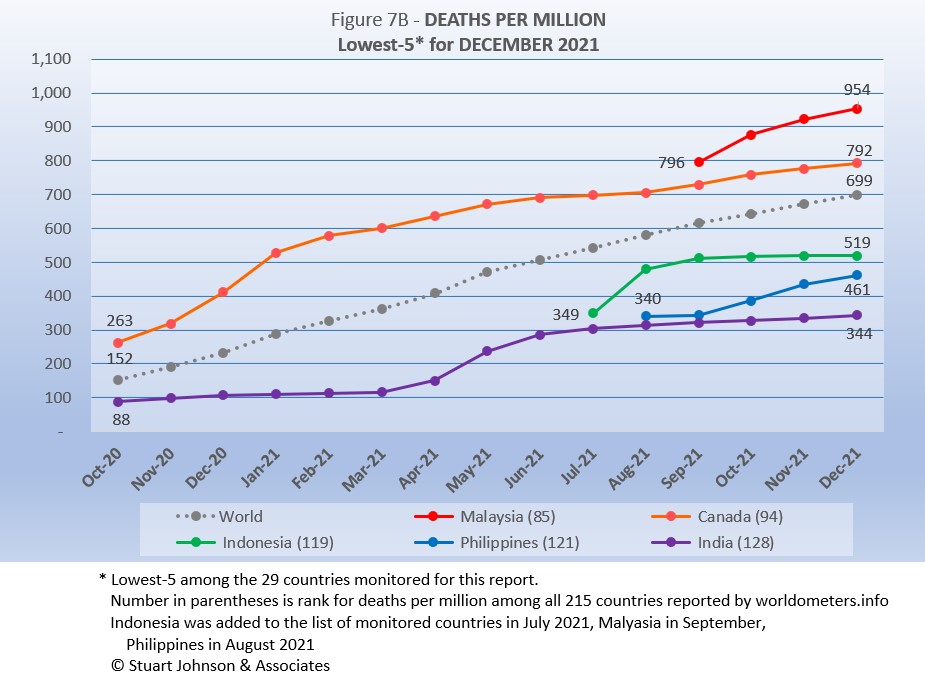

Malaysia replaces Turkey this month. The other four countries return, in the same order for the fourth month.

The global curve shows a very steady growth against which the other countries can be compared. Malaysia and Philippines, both added to the list since July, showed a growth rate steeper than the global curve. Canada showed slowing growth around June, then began to grow agarin from August on, though at a slower pace than the global curve. Indonesia and India have flattened noticeably since September.

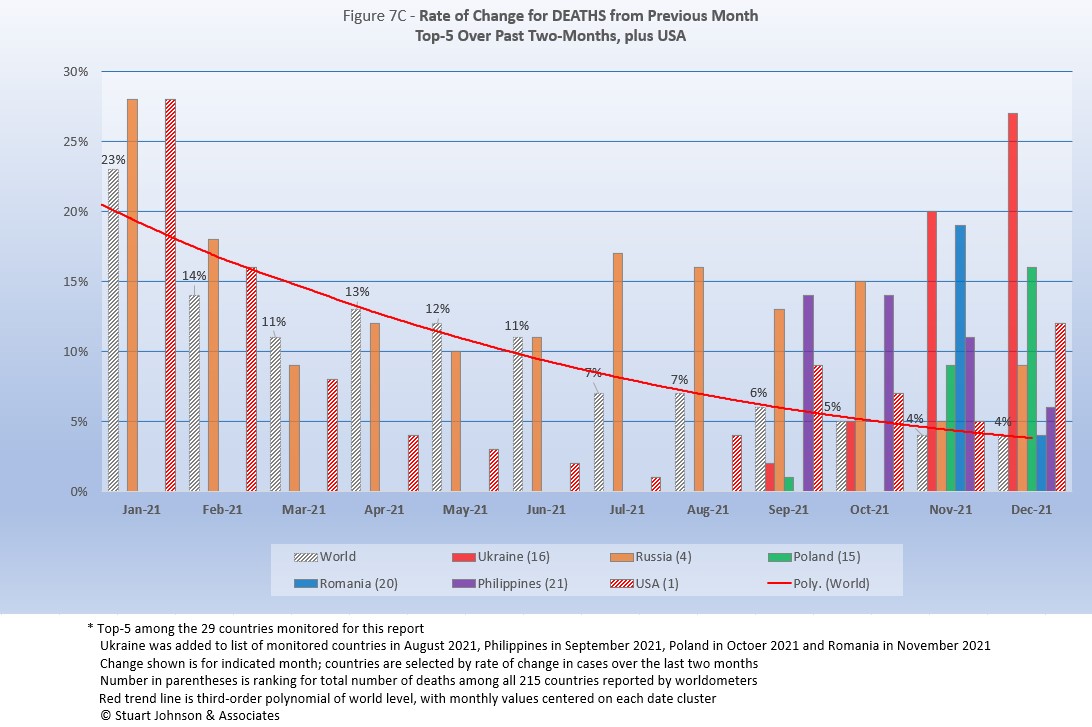

As with the comparable chart for Rate of Change for Cases (Figure 6C), countries for Rate of Change for Deaths (Figure 7C) are selected based on the change over two-months (end of October to end of December) in reported COVID deaths. The focus of the selection is on recent changes, but the chart goes back to November to keep the surges of late 2020 in perspective.

Poland and Romania replaceTurkey and Malaysia this month.

Except for Russia and USA, the other countries were all added to the list of monitored countries in the last few months. You can see the extent of change for those months, most of which are well above the global level, which dropped from 23% in January 2021 to 5% by October and then down to 4% in November and December.

Just as I did this month for Changes in Cases (FIgure 6C), the following chart gives a sense of the movement of change across different parts of the globe over time. You will see similarities with the chart for Cases but also some striking differences. In particular, compare the list for December, where the top-5 are all in western Europe, while the biggest changes in Deaths are found in Eastern Europe and Asia.

| Month | Top-5 for Change in Cases Over 2 Months | Note | ||||

|---|---|---|---|---|---|---|

| June 2021 | Peru | India | Argentina | Colombia | Bolivia | South America surging |

| August 2021 | Ecuador | Russia | Iran | Argentina | Colombia | Delta begins |

| October 2021 | Philippines | Russia | Ukraine | Turkey | Iran | Delta fading |

| December 2021 | Ukraine | Russia | Poland | Romania | Philippines | Omicron dominant |

USA was lower than the global level of change from February through August, then went above it, hitting 9% in September, then dropped to 5% in November, just one point higher than the global level. In December, however, USA deaths increased to 12%, well above the global level of 4%.

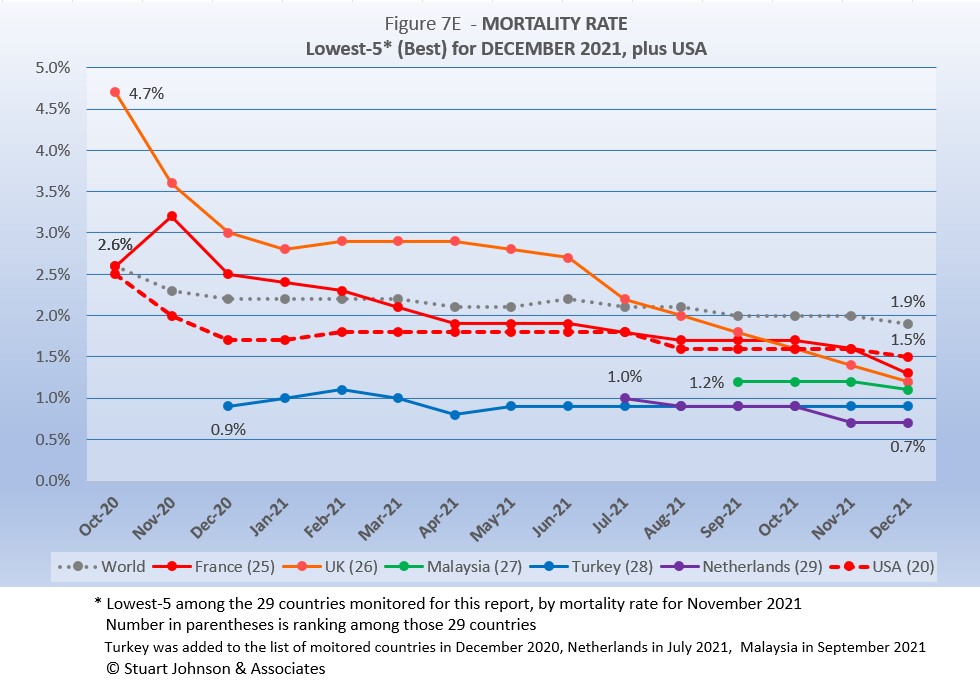

Mortality Rate

Mortality Rates (percentage of deaths against reported cases) have generally been slowly declining. This is not surprising as several factors came into play:

- In the early days of the pandemic, there was a high proportion of "outbreak" cases (nursing homes, retirement communities, other settings with a concentration of more vulnerable people). As the pandemic continued the ratio of "community spread" (with lower death rates) to "outbreaks" increased and the overall Mortality Rate went down.

- As knowledge about treatment increased, mortality went down.

- Since the death count is more certain (though not without inaccuracies), the side of the equation that can change the most is cases. As testing revealed more cases, the Mortality Rate would naturally go down because it would only affect cases and not deaths. In addition, the official numbers do not take into account a potentially higher number of people with the virus who are unreported and asymptomatic, so the real mortality rate could be even lower.

- Vaccinations started in January 2021 and available in January 2022 will be the first anti-viral drug (though these should impact both cases and deaths).

In recent months, the delta variant and now omicron produced surges in cases, particularly among those who are unvaccinated. The death rate stayed lower than early on in the pandemic, which results in a lower mortality rate (remember, however, that deaths from variants may become more evident in coming months).

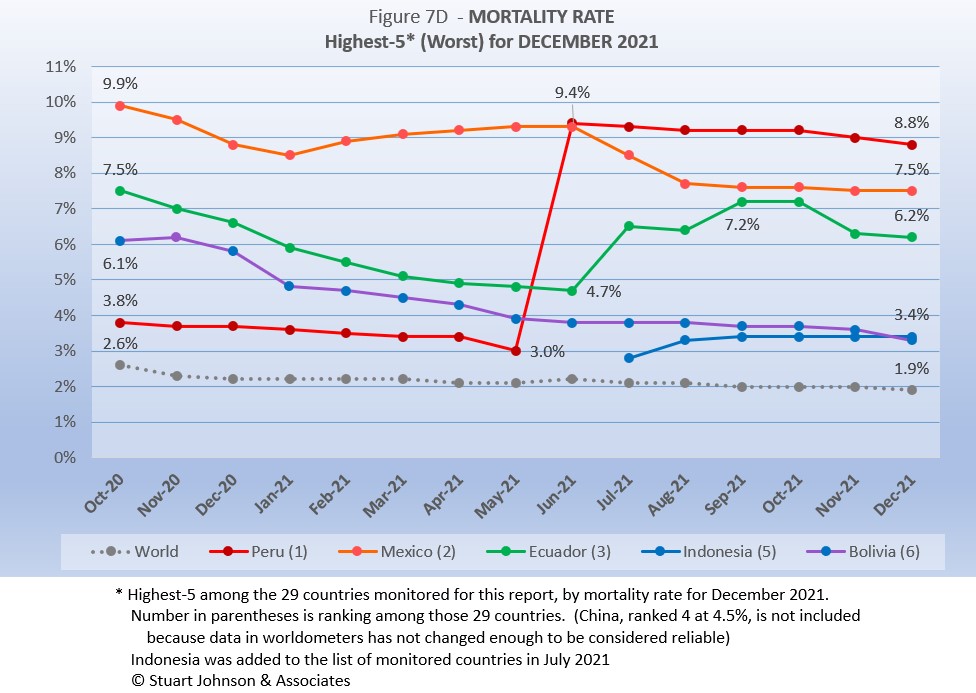

The Global mortality rate has dropped from 2.6% in October 2020 to 2.1% by April, where it stayed except for a bump back to 2.2% in June, before dropping again, reaching 1.9% in December. The median for the countries monitored for this report has dropped from 4.8% in October 2020 to 2.8% for eight months, then down to 2.7% in December.

All five of the top-5 in mortality rate (among the 29 countries monitored) return in December—for the fifth straight month. Despite a generally improving picture for South America, three of the five with the worst mortality rates are located there and Mexico is geographically close.

Peru was in fourth place and declining until June when its corrected death numbers drove Mortality to 9.4%, just ahead of Mexico at 9.3%. Since then Peru has slowly declined, ending December at 8.8%. Mexico started with the highest mortality rate, 9.9%, went down then back up before making a more concerted decline in July, though it has leveled off the last four months. Ecuador was on a steady path of dropping mortality rate through June, then has gone up more than Mexico went down, with the two looking like they would cross paths in August. However, both Mexico and Ecuador leveled off and were running on parallel tracks until Ecuador declined significantly in November and a little more in December.

Bolivia is the one South American country among the five with the worst mortality to show a steady decline (which is good). Though the pace of the decline has slowed since May, it made a noticeable adjustment down in December, which moved it to fourth place in the ranking by a very slim margin. Indonesia was added to the list of monitored countries in July, coming in at #5, rising some in August, then leveling off to maintain a small but diminishing separation with Bolivia since September. In December it's flat path put it at #4, in a near tie with Indonesia. All five have been significantly above the Global rate since at least October 2020 when this chart begins.

Since these represent the best mortality rates, where low is good, the "rank" order is actually in reverse.

France replaced India in December. Over time, the spread of mortality rates has become tighter, with all five, plus USA below the global rate of 1.9%.

USA has been below the global level through the time covered by this chart. Starting at 2.5%, it quickly dipped to 1.7% by December 2020, rose to 1.8% for six months, then settled back to 1.6% for four months. It ended December at 1.5%, ranking 20 among the 29 countries monitored (where lower rank represents better mortality), five places above France. .

How real is the threat of death from COVID? That's where successful mitigation comes in. Worldwide, by the end of December, 1 in 28 people have been reported as having contracted COVID and 1 in 1,450 people have died. In USA, while the mortality rate is low, because the number of cases is so high, 1 in 391 have died through December 2021—between Columbia (1 in 392) and Argentina (1 in 390). India has the lowest impact from death, with 1 death for every 2,869 people. Peru is the worst, at 1 in 163.

With low mortality, USA should have been able to keep deaths much lower, but the extraordinarily high number of cases means more deaths. Later in the report I will talk about those who stress the importance of avoding hospitilazation, with the example of Denmark where cases have soared since delta and omicron but hospitalization and death remained very low. Even so, without a better-than-global mortality rate, the USA death rate would be far higher. Compared to the mortality rate during the 1918 pandemic, it could be ten times worse than it is. Even at the Global mortality rate of 1.9%, USA would have had just over 1-million deaths (for 55-million cases) by the end of December, instead of 845-thousand with a mortality rate of 1.5%. The response of the health care system and availability of vaccines are part of keeping mortality down, but it's far too early to detail the cause for that positive piece of the COVID picture for USA.

Tests

The same five countries remain on top in COVID testings, having been in the same order since March 2021.

USA remains ahead of other countries in reported COVID tests administered, at 811-million, 19% ahead of India, widening the gap since September, but well below the 56% gap in April. UK continues at the pace it set in February (causing it to move into third place back in March). Russia and France remain on paths of slower growth in raw numbers.

Since these are raw numbers, it is important to recognize the size of the country. It is also the case that COVID tests can be administered multiple times to the same person, so it cannot be assumed that USA has tested almost all of its population of some 331-million. Some schools and organizations with in-person gatherings are testing as frequently as once a week or more for those who are not yet fully vaccinated. That's a lot of testing!

Another wrinkle in the statistics for tests will be the increasing availability of home tests, where we may able to track sales but not tests administered since they are not like PCR and rapid tests offered by agencies that report testing to health authorities. While the statistics for tests have a degree of ambiguity, they are useful in showing the problem of equity, which is evident in the next chart.

The same five countries return in the same order from November.

Romania, Ukraine and Mexico all show upward movement in tests while Bolivia and Ecuador remain at the bottom, both at lower rates of growth.

As questions arise about equity of testing between countries, check the number of tests for countries of similar size (within the 29 monitored countries):

- Mexico: 12.4M tests for 128.9M population, compared to Philippines: 25.2M tests for 109.6M population (2.0X the tests)

- Ukraine: 16.8M tests for 43.7M population, compared to Argentina: 28.0M tests for 45.7M population (1.7X)

- Peru: 21.7M tests for 33.0M population, compared to Malaysia: 41.0M tests for 32.4M population (1.9X)

- Ecuador: 2.1M tests for 17.6M population, compared to Netherlands: 21.1M tests for 17.1M population (10.0X)

- Bolivia: 2.6M tests for 11.7M population, compared to Belgium: 27.2M tests for 11.6M population (10.5X)

Tests per million adds another perspective. Fig. 8C shows the five countries with the highest tests per million. All five have been in the same order since July (though they appear tied, France was slightly ahead of USA in July).

UK, already the most aggressive in testing, increased its numerical lead each month since February, with a reported 5.9-million tests-per-million population in December, roughly 6 tests per person. France maintained its lead over USA, ending at 2.8-million tests-per-million, approaching three tests per person. USA continues on a straight line trajectory, with a very slight dip in June and July, followed by a slight increase for August through December, reaching 2.4-million tests-per-million. Belgium and Italy are not far behind, tracking closely with France and USA. Italy is up to 2.3-million tests-per-million, virutally tied with Belgium.

Anything over 1,000 (or "x-million tests-per-million") represents more tests than people (1,000 on the chart actually means 1,000,000), but as mentioned above, that does not mean that everyone had been tested. Some people have been tested more than once, and some are being tested regularly or with increased frequency.

The same five countries have appeared for five months, with some change of order in the last two months..

The contest to escape the bottom five for test-per-million has resulted in a covergence of the upper three, with Indonesia taking the lead this month with 227-thousand tests-per-million population, in a virutal tie with Philippines at 226K and only slightly behind them Bolivia—which broke away from Ecuador and Mexico back in March—at 221K. Had Bolivia stayed on the steeper growth from May to August, it would be well ahead of the others and possibly not even be in the lowest five any longer. That leaves Ecuador and Mexico, which plod along on similar paths increasingly separated from the others.

While improvement is evident in all five, the equivalent proportion of tests to population remains very low, from roughly 9% to 23% (and that would be reduced in some individuals receive more than one test). This illustrates the arguments over inequity in resources among countries.

Vaccinations

Figure 9A compares USA with the top-5 and bottom-5 of monitored countries by total doses administered. As you can see USA leans toward the upper countries, but is clearly behind Chile, with the highest proportion of fully vaccinated, at 90%. Including partial vaccination, USA comes up to 73%, which just barely surpasses the proportion of fully vaccinated in Argentina. USA total vaccination is clearly below the fully vaccinated of the four other top countries. . On the other hand, USA is well ahead of the bottom five of the 29 monitored countries for either total doses or fully vaccinated.

As pointed out in other parts of this analysis, Figure 9A does not tell the whole story. It's a bit of an apples and oranges comparison, with one major factor being the population of each country.

Taking population into account paints a different picture for USA compared to other monitored countries. In Figure 9B you see the five most populous countries on the left and the five smallest (of those monitored for this report) on the right. (China is not included because of unreliability of its data).

Brazil is ahead of USA in both full and total vaccinations, and the fully vaccinated of both exceed the total doses of India, Indonesia, and Russia.

On the side of smallest countries, all except Bolivia are ahead of all five of the bggest countries in fully vaccinated. Chile is far ahead of all ten in total and fully vaccinated. Ecuador is one point better than Brazil in total vaccinations, Netherlands and Belgium one point lower.

Thus, individual regions, provinces or states of the largest countries may be doing as well as some smaller countries, while the entire country lags behind the smaller ones.

CAUSES OF DEATH IN USA

Early in the reporting on COVID, as the death rate climbed in the U.S., a great deal of attention was given to benchmarks, most notably as it approached 58,000, matching the number of American military deaths in the Vietnam War. At that time, I wrote the first article in this series, "About Those Numbers," in which I looked at ways of viewing the data, which at the time of that writing in May 2020 was still focused on worst-case models and familiar benchmarks, like Vietnam.

Three Critical Curves

Figure 10 shows the number of USA COVID cases and deaths against the top-10 causes of death as reported by CDC. That data reflects 2019 figures, the latest year available.

Notice that for nearly nine months, the curve for deaths was increasing at a faster rate than cases. Then, starting in October 2020 the curve for cases took a decided turn upward, while deaths increased at a more moderate pace (the two curves use different scales, but reflect the relative rate of growth between them).

I added the curve for hospitalization last month. Unlike the case and death curves, which are cumulative, hospitalizations reflects the number of cases requiring hospitalization each month. You can see three peaks: the highest with the initial surge (before vaccines became available) in December 2020, followed by August 2021 (delta) and December 2021 (the beginnig of the omricon variant).

Benchmarking the Numbers

Media reporting tended to focus on easily grasped benchmarks—deaths in Vietnam or World War II, or major

milestones like 500,000 (crossed in February 2021).

In August we passed the 2018 level for #1 heart disease (655-thousand), then passed it again in September when the 2019 data "moved the goal post" to 259-thousand. Another significant benchmark, pointed out in some news reports, was the 675-thousand estimate for deaths in USA during the 1918 pandemic. Adjusted for population growth, however, that number would now be around 2-mllion.

Having passed the annual death benchmarks, now we can only watch as the numbers continue to climb...

The latest "Ensemble Forecast" from CDC suggests that by our next report we should see:

...the number of newly reported COVID-19 deaths will likely increase over the next 4 weeks, with 19,700 to 30,500 new deaths likely reported in the week ending January 29, 2022. {Past reports included an estimated total, but that was not done this time because "Current forecasts may not fully account for the emergence and rapid spread of the Omicron variant or changes in reporting during the holidays and should be interpreted with caution."]

Note: As I've referenced in the notes for several charts, the data from worldometers.info tends to be ahead of CDC and Johns Hopkins by about 3%, because of reporting methodology and timing. I use it as a primary source because its main table is very easy to sort and provides the relevant data for these reports. Such differences are also found in the vaccine data from ourworldindata. Over time, however, trends track with reasonable consistency between sources.

Perspective

The 1918-19 Spanish Flu pandemic is estimated to have struck 500 million people, 26.3% of the world population of 1.9-billion at that time. By contrast, we're now at 3.1% of the global population. Deaths a century ago have been widely estimated at between 50- and 100-million worldwide, putting the global mortality rate somewhere between 10 and 20-percent. It has been estimated that 675,000 died in the U.S.

IF COVID-19 hit at the same rate as 1918, we would see about 2-billion cases worldwide by the time COVID-19 is over, with the global population now at 7.9-billion—four times what it was in 1918. There would be 200- to 400-million deaths. The U.S. is estimated to have had 27-million cases (one-quarter of the population of 108-million) and 675,000 deaths. Today, with a population of 331-million (a three-fold increase from 1918) this would mean more than 80-million cases, and 2- to 4-million deaths.

However, at the present rate of confirmed cases and mortality while the total number of global cases could approach 500 million or more—comparable to 1918 in number—that would be one-quarter of 1918 when taking population growth into account . .. and assuming the pandemic persists as long as the Spanish Flu, which went on in three waves over a two year period. (That now seems increasingly likely). At the present rate of increase (close to 14.3-million cases per month) it would take another 15 months to reach 500-million, roughly March of 2023. That rate has accelerated as delta and omicron surges raised the case total significantly.

If the total number of cases globally did approach 500-million, using the global mortality rate of 1.9% in December, there would be roughly 9.5-million deaths worldwide. Tragic but far below the number reported for 1918 (50-million) with an even wider gap (200 million) when taking population growth into account.

Earlier in the summer, I indicated that with vaccination in progress and expected to be completed in the U.S. by the end of summer, the end of COVID-19 could come sooner. Like 1918, however, there have been major complicating factors, such as the combination of the delta and omicron variants with a high number of unvaccianted (ironically hitting hardest Europe and USA where vaccines are readily available). While we may have thought the end of the pandemic was in sight, it is still too early to make predictions on the duration and severity of the COVID-19 pandemic globally. Indeed, the slope of the global growth of cases and deaths still looks like the trajectory of an airplane climbing toward cruising altitude.

Despite the darkening forecast since delta and omicron, the vast difference in scale between the Spanish Flu pandemic a century ago and COVID-19 even aproaching two years in, still cannot be denied.. Key differences are the mitigation efforts, treatments available today (though still leaving the health care system overwhelmed in some areas during surges), and the availability of vaccines and the first anti-viral drug for those recently infected. In addition, in 1918 much of the world was focused on a brutal war among nations (World War I) rather than waging a war against the pandemic, which ran its course and was undoubtedly made much worse by the war, with trans-national troop movements, the close quarters of trench warfare, and large public gatherings supporting or protesting the war. Another factor clearly shown in the charts in these reports has been that the rate of increase in deaths has for some time now been well below the increase in cases, especially since vaccines became available in January 2021.

VACCINATIONS IN USA

With remarkable speed (it usually takes years to develop vaccines), two COVID vaccines were granted emergency approval for use in USA starting in January 2021—the one by Pfizer requires super-cold storage, which limits its deployment. The other, by Moderna, requires cold storage similar to other vaccines. Both of these require two doses, which means that vaccine dosages available must be divided in two to determine the number of people covered. By March 2021 Johnson & Johnson had been granted approval for a single-dose vaccine. The numbers in Figure 11 represent the status of all three vaccines as of December 31 (as reported by CDC, which will be slightly different than ourworldofdata data used in earlier vaccination charts). .

A person is considered "fully vaccinated" two weeks after the final (or only) vaccine dose; roughly five to six weeks total for Pfizer and Moderna and two weeks for Johnson & Johnson.

After a rapid start, vaccination slowed in late spring. Figure 11 then showed an upturn in Doses Distributed and Administered in August, a sign that perhaps the delta variant provided the impetus for increased vaccinations. The rate of increased distribution continued into December. Doses Administered dipped slightly in September then recovered in October. There was a slight increase in fully vaccinated in November—up 3.6% from October, most of that from opening vaccinations to those ages 12-18—but December showed a dip in the curve, with a more modest increase of 2.1%.

Those getting boosters is up to nearly 69-million in three months, a third of those who are already fully vaccinated. In addition, in early November the CDC expanded vaccination approval for children ages 5-12 and in December the FDA approved the first anti-viral drug, Pfizer's Paxlovid.

Debates over masking policy and mandatory vaccination provides evidence that the real battle now is vaccination. A year ago we were debating lock-downs. Today the debate is how to be open but remain safe. Will the rise of infections and the call for more masking be enough to spur more vaccinations? For some, perhaps, but whether low levels of vaccinations have prolonged the pandemic (around the world) will be the subject of discussion and debate for years to come.

Vaccinating over 300 million people in the United States (much less a majority of the billions around the world) is a daunting task. It is a huge logistical challenge, from manufacture to distribution to administration. Yet, it is amazing that any of this is possible this soon after the identification of the virus just over 21 months ago—and that according to available data, more than half of the world's population of 9.8-billion have been at least partially vaccinated.

There is a delicate balance between maintaining hope with the reality that this is a huge and complicated logistical operation that will take time, with the prospect that COVID will be with us for some time—morphing from a global pandemic to an ongoing endemic like seasonal flu (more on this below)—partly because getting shots into the arms of the unvaccinated is proving to be a far bigger challenge than most officials assumed a few months ago.

As the richer countries with access to more resources make progress, the global situation is raising issues of equity and fairness within and between countries. Even as the U.S. and other countries launch large scale vaccine distribution to a needy world community, the immensity of the need is so great that a common refrain heard now is whether this aid is too little, too late. As COVID fades into a bad memory in countries able to provide help, will the sense of urgency remain high enough to produce the results needed to end this global pandemic?

Maintaining Perspective

In the tendency to turn everything into a binary right-wrong or agree-disagree with science or government, we ignore the need to recognize the nature of science and the fact that we are dealing with very complicated issues. So, in addition to recommending excellent sources like the Centers for Disease Control and Prevention (CDC), it is also wise to consider multiple qualified sources.

While there has been much focus placed in trusting "the science," it is important to recognize that science itself changes over time based on research and available data. In the highly volatile political atmosphere we find ourselves in (not just in the U.S., but around the world), there is a danger of not allowing the experts to change their views as their own understanding expands, or of trying to silence voices of experts whose views are out of sync with "the science" as reported by the majority of media outlets.

In an earlier report, I mentioned the Greater Barrington Declaration, currently signed by more than 61-thousand medical & public health scientists and medical practitioners (and 848-thousand "concerned citizens"), which states "As infectious disease epidemiologists and public health scientists we have grave concerns about the damaging physical and mental health impacts of the prevailing COVID-19 policies, and recommend an approach we call Focused Protection."

For a personal perspective from a scholar and practitioner who espouses an approach similar to the Focused Protection of the Greater Harrington Declaration, see comments by Scott W. Atlas, Robert Wesson Senior Fellow at the Hoover Institution at Stanford University, in an article "Science, Politics, and COVID: Will Truth Prevail?"

Several months ago on SeniorLifestyle I posted an article by Mallory Pickett of The New Yorker, "Sweden's Pandemic Experiment," which provides a fair evaluation of the very loose protocols adopted by Sweden, essentially a variation of the "Focused Protection" approach. The "jury is still out" on this one, so judge for yourself whether Sweden hit the mark any better than the area in which you live.

UPDATE ON SWEDEN: As of early January, Sweden reported nearly 1.4-million cases of COVID, or 13.5% of its population of 10.2-million. There have been 15,326 deaths, for a mortality rate of 1.1%. Cases went up 1.4% over the previous month, but mortality fell 0.1%. Ranked 89 by population, Sweden was #37 in cases and #46 in deaths (down one rank in both cases and deaths since last month). Hospializations rose 91% in December, from 272 to 519, compared to an 11% increase last month.

That puts Swedent

below USA (16.7%) and even with Spain (13.5%) in cases as a proportion of population, with a mortality equal to that of Malaysia (1.1%), near the bottom (best) among the 29 countries monitiored for this report and well below the global rate of 1.9%.

FROM PANDEMIC TO ENDEMIC: After posting last month's Perspectives, I posted on SeniorLifesytle an article by Sarah Zhang from The Atlantic, "America Has Lost the Plot on COVID." In it, she suggests that America (and the world) is headed not toward the eradication of COVID-19, but its transformation from pandemic to endemic, joining the seasonal flu as something we will deal with for some time. Getting there, she contends, is more a matter of mixed policy strategies than "following the science," but coming to grips with its inevitability could help lead to more effective strategies.

Zhang mentions Denmark as a counterpoint to what is happening in America, saying

One country that has excelled at vaccinating its elderly population is Denmark. Ninety-five percent of those over 50 have taken a COVID-19 vaccine, on top of a 90 percent overall vaccination rate in those eligible. (Children under 12 are still not eligible.) On September 10, Denmark lifted all restrictions. No face masks. No restrictions on bars or nightclubs. Life feels completely back to normal, says Lone Simonsen, an epidemiologist at Roskilde University, who was among the scientists advising the Danish government. In deciding when the country would be ready to reopen, she told me, “I was looking at, simply, vaccination coverage in people over 50.” COVID-19 cases in Denmark have since risen—under CDC mask guidelines, the country would even qualify as an area of “high” transmission where vaccinated people should still mask indoors. But hospitalizations are at a fraction of their January peak, relatively few people are in intensive care, and deaths in particular have remained low.

Crucially, Simonsen said, decisions about COVID measures are made on a short-term basis. If the situation changes, these restrictions can come back—and indeed, the health minister is now talking about that possibility. Simonsen continues to scrutinize new hospitalizations everyday. Depending on how the country’s transition to endemicity goes, it could be a model for the rest of the world.

UPDATE ON DENMARK: In early January, Denmark reported 872-thousand cases of COVID or 15% of its population of 5.8 million (a huge increase, from 8.5% and 497-thousand cases last month). In spite of the explosion in cases, deaths increased by only 410 to 3,322, for a mortality rate of 0.4% (down 0.2% from last month). Ranked 113 in population, Denmark was #48 in cumulative cases and #91 in deaths (from #64 and #95 last month). Hospitalizations rose 61%, but that was down 251 to 665 (compared to a 78% increase in November and 151% in October, opposite the dramatic rise in cases).

While Denmark's case-to-population proportion is nearly 5 times the global rate of 3.3%, its mortality rate is most striking, and the point of Zhang's observation about focusing on the prevention of hospitalization. The mortality rate (0.4%) is below Netherlands (0.7%), which is the lowest among the 29 monitored countries, and well below the global rate of 1.9%. Does that mean that Denmark is actually a success? How do we interpet staggering surges in cases when hospitalizaton—and death—can be held at bay?

How we evaluate the many approaches used to deal with COVID will determine how we prepare for and approach the next global event—including what now appears to be a transition from pandemic to endemic for COVID-19.

My purpose in mentioning these sources is to recognize that there are multiple, sometimes conflicting, sometimes dissenting, voices that should be part of the conversation. The purpose of these monthly reports remains first and foremost to present the numbers about COVID-19 in a manner that helps you understand how the pandemic is progressing and how the U.S. compares to the world—and how to gain more perspective than might be gathered from the news alone.

Profile of Monitored Continents & Countries

(Data from worldometers.info).

| Rank | Country | Population | Share of World Population |

Density People per square km |

Urban Population |

Median Age |

| WORLD | 7.82B | 100% | -- | -- | -- | |

| Top 10 Countries by Population, plus Five Major Continents See lists of countries by continent |

||||||

| - | ASIA | 4.64B | 59.3% | 150 | 51 countries | 32 |

| 1 | China | 1.44B | 18.4% | 153 | 61% | 38 |

| 2 | India | 1.38B | 17.7% | 454 | 35% | 28 |

| - | AFRICA | 1.34BM | 17.1% | 45 | 59 countries | 20 |

| - | EUROPE | 747.7M | 9.6% | 34 | 44 countries | 43 |

| - | S AMERICA | 653.8M | 8.4% | 32 | 50 countries | 31 |

| - | N AMERICA | 368.9M | 4.7% | 29 | 5 countries | 39 |

| 3 | USA | 331.5M | 4.3% | 36 | 83% | 38 |

| 4 | Indonesia** | 274.5M | 3.5% | 151 | 56% | 30 |

| 5 | Pakistan* | 220.9M | 2.8% | 287 | 35% | 23 |

| 6 | Brazil | 212.9M | 2.7% | 25 | 88% | 33 |

| 7 | Nigeria* | 206.1M | 2.6% | 226 | 52% | 18 |

| 8 | Bangladesh* | 165.2M | 2.1% | 1,265 | 39% | 28 |

| 9 | Russia | 145.9M | 1.9% | 9 | 74% | 40 |

| 10 | Mexico | 129.3M | 1.7% | 66 | 84% | 29 |

| *these countries do not appear in the details because they have not yet reached a high enough threshold to be included **Indonesia was added to the monitored list in July 2021 Other Countries included in Analysis most have been in top 20 of cases or deaths |

||||||

| Rank | Country | Population | Share of World Population |

Density People per square km |

Urban Population |

Median Age |

| 13 | Philippines (2) | 109.6M | 1.4% | 368 | 47% | 26 |

| 17 | Turkey | 84.3M | 1.1% | 110 | 76% | 32 |

| 18 | Iran | 83.9M | 1.1% | 52 | 76% | 32 |

| 19 | Germany | 83.8M | 1.1% | 240 | 76% | 46 |

| 21 | United Kingdom | 67.9M | 0.9% | 281 | 83% | 40 |

| 22 | France | 65.3M | 0.8% | 119 | 82% | 42 |

| 23 | Italy | 60.4M | 0.8% | 206 | 69% | 47 |

| 25 | South Africa (1) | 59.3M | 0.8% | 94 | 67% | 28 |

| 29 | Colombia | 50.9M | 0.7% | 46 | 80% | 31 |

| 30 | Spain | 46.8M | 0.6% | 94 | 80% | 45 |

| 32 | Argentina | 45.2M | 0.6% | 17 | 93% | 32 |

| 35 | Ukraine (1) | 43.7M | 0.6% | 75 | 69% | 41 |

| 39 | Poland (1) | 37.8M | 0.5% | 124 | 60% | 42 |

| 39 | Canada | 37.7M | 0.5% | 4 | 81% | 41 |

| 43 | Peru | 32.9M | 0.4% | 26 | 79% | 31 |

| 45 | Malaysia (3) | 32.4M | 0.4% | 99 | 78% | 30 |

| 61 | Romania (4) | 19.1M | 0.2% | 84 | 55% | 43 |

| 63 | Chile | 19.1M | 0.2% | 26 | 85% | 35 |

| 67 | Ecuador | 17.6M | 0.2% | 71 | 63% | 28 |

| 69 | Netherlands (1) | 17.1M | 0.2% | 508 | 92% | 43 |

| 80 | Bolivia | 11.7M | 0.1% | 11 | 69% | 26 |

| 81 | Belgium | 11.6M | 0.1% | 383 | 98% | 42 |

(1) Added to the monitored list in July 2021 |

||||||

Scope of This Report

What I track

From the worldometers.info website I track the following Categories:

- Total Cases • Cases per Million

- Total Deaths • Deaths per Million

- Total Tests • Tests per Million (not reported at a Continental level)

- From Cases and Deaths, I calculate the Mortality Rate

Instead of reporting Cases per Million directly, I try to put raw numbers in the perspective of several key measures. These are a different way of expressing "per Million" statistics, but it seems easier to grasp.

- Country population as a proportion of global population

- Country cases and deaths as a proportion of global cases and deaths

- Country cases as a proportion of its own population

- Cases and deaths expressed as "1 in X" number of people

Who I monitor

My analysis covers countries that have appeared in the top-10 of the worldometers categories since September 2020. This includes most of the world's largest countries as well as some that are much smaller (see the chart in the previous section).

This article was originally posted on my InfoMatters blog.

Search all articles by Stu Johnson

Stu Johnson is principal of Stuart Johnson & Associates, a communications consultancy in Wheaton, Illinois. He is publisher and editor of SeniorLifestyle, writes the InfoMatters blog on his own website and contributes articles for SeniorLifestyle. • Author bio (website*) • E-mail the author (moc.setaicossajs@uts*) • Author's website (personal or primary**)* For web-based email, you may need to copy and paste the address yourself.

** opens in a new tab or window. Close it to return here.

Posted: January 5, 2022 Accessed 306 times

![]() Go to the list of most recent Health & Wellness Articles

Go to the list of most recent Health & Wellness Articles

![]() Search Health & Wellness (You can expand the search to the entire site)

Search Health & Wellness (You can expand the search to the entire site)

![]() Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Loading requested view...

Loading requested view...