See listing of Recent and Most Popular articles on the Home Page

My World

Category: Government & Politics / Topics: Financial • Government • Planning • Policy, Policy Formation • Politics • Trends

Top Ten Ways to Reduce the National Debt

Posted: April 24, 2017

With tongue only partly in cheek

I have in my right hand, direct from my home office in Corn Borer, Indiana, “Top Ten Ways To Reduce the National Debt.”

10. Sponsor a national garage sale (Do we really need two Dakotas?)

9. Make Chuck-E-Cheese tokens legal tender

8. Turn Blair House into an upscale bed and breakfast

7. Make the U.S. government an Amway distributor (just sign up ten more countries, who sign up ten more countries . . . )

6. Tax junk mail, spam and telemarketing

5. Creditors who forgive debts can rename national landmarks: The Wan Ting Monument, The Grand Dragon Canyon, The Statue of Liang Ting, . . .

4. Have Mark Zuckerberg write a check

3. Have senators and representatives salaries based on median income of their constituents

2. Have the presidency be a volunteer position. (Does someone worth millions/billions need $400,000 a year, plus housing and generous pension?)

1. Cut up Congress’ credit card

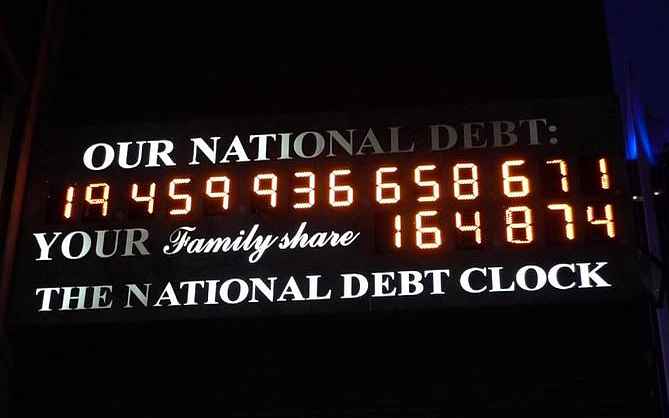

Okay, the national debt is no laughing matter. According to InsideGov here’s the balance sheet for 2015:

Total receipts: 2,960,000,000,000

Total expenditures: 3,360,000,000,000

National debt in December: 18,800,000,000,000

Proposed budget cuts per year: 30,000,000,000

To put that in perspective, if that were an individual making nearly $30,000 per year:

Total receipts: 29,600

Total expenditures: 33,600

Total debt: 188,000

Proposed budget cuts per year: 300

According to the government’s own Consumer Financial Protection Bureau, one’s debt-to-income ratio should be no more than 43 percent (annual debt divided by annual gross income). The government’s own ratio is . . . a drum roll, please . . . 560 percent! That’s eight times its own advice.

Those expenditures fall under three categories:

Mandatory spending makes up 65 percent of the total budget. Nearly half (49 percent) is Social Security and unemployment benefits; 38 percent is Medicare and Health.

Discretionary spending makes up 29 percent of the total budget with 54 percent of that going to the military and 7% government overhead. (Surprisingly, government operation makes up less than 2 percent of the total budget.)

Interest on Federal debt is 6 percent.

So . . .

The sky is not falling!

The United States earns the following credit scores: Standard & Poor’s: AA+ with stable outlook, Moody’s: Aaa with stable outlook, Fitch’s AAA with stable outlook.

The sky is clouding up as storms approach

According to US News, the current $19 trillion tab “is growing at a staggering pace of more than $58,000 per second.” The report asks, “When will the government’s habit of maxing out its credit cards finally hit home? Here a few ways you might feel the pinch of Uncle Sam’s borrowing binge . . .” It lists:

Higher interest rates. “At some point, it may be much harder to finance our debt,” says Lynn Reaser, chief economist at Point Loma Nazarene University. “As a result, we would see an economic or market solution and that would mean either higher interest rates or a lower value of the dollar, or a combination of both.”

Slower economic growth, weaker job markets. The US News report continues: “If interest rates ramp up, a greater portion of the government’s budget will go toward interest payments, leaving fewer dollars for other, more economically stimulating types of spending, such as building roads or providing tax incentives for small businesses.”

Higher taxes. Georgetown University’s finance professor Reena Aggarwal warns that cutting spending is only half of the solution. “At some point, the government has to think about raising more revenue, which means higher taxes. If we don’t address this debt problem, it’s going to end up being a bigger problem.”

I have often quipped that, like the trio off to see the Wizard, Republicans need a heart and Democrats need a brain. And both parties need courage to address the government’s economic spiral. For decades, Congress has kicked the can down the road in a series of government shutdowns and emergency spending bills. In the past 50 years, the United States has been in the black only seven fiscal years! (In 1957 and 1960 under Dwight Eisenhower; 1969 under Richard Nixon; 1998, 1999 and 2000 under Bill Clinton; and 2001 under George W. Bush.)

What is needed is a bipartisan effort to enlist the best economists to create a strategy to stop the hemorrhage of red ink. But what can you and me—the lowly blood donors—do?!

• Vote for legislators who will address deficit spending . . . now.

• Pray not only for congressional courage but wisdom to resolve it.

• And, I’d suggest seriously considering numbers 3, 2 and 1 on my top ten list!

Search all articles by James N. Watkins

Jim Watkins is a humorist, author, and speaker who says of himself that he "loves God, his family, writing, speaking and Chinese food—in that order" • Author bio (website*) • E-mail the author (moc.sniktawsemaj@mij*) • Author's website (personal or primary**)* For web-based email, you may need to copy and paste the address yourself.

** opens in a new tab or window. Close it to return here.

Posted: April 24, 2017 Accessed 637 times

![]() Go to the list of most recent My World Articles

Go to the list of most recent My World Articles

![]() Search My World (You can expand the search to the entire site)

Search My World (You can expand the search to the entire site)

![]() Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Loading requested view...

Loading requested view...